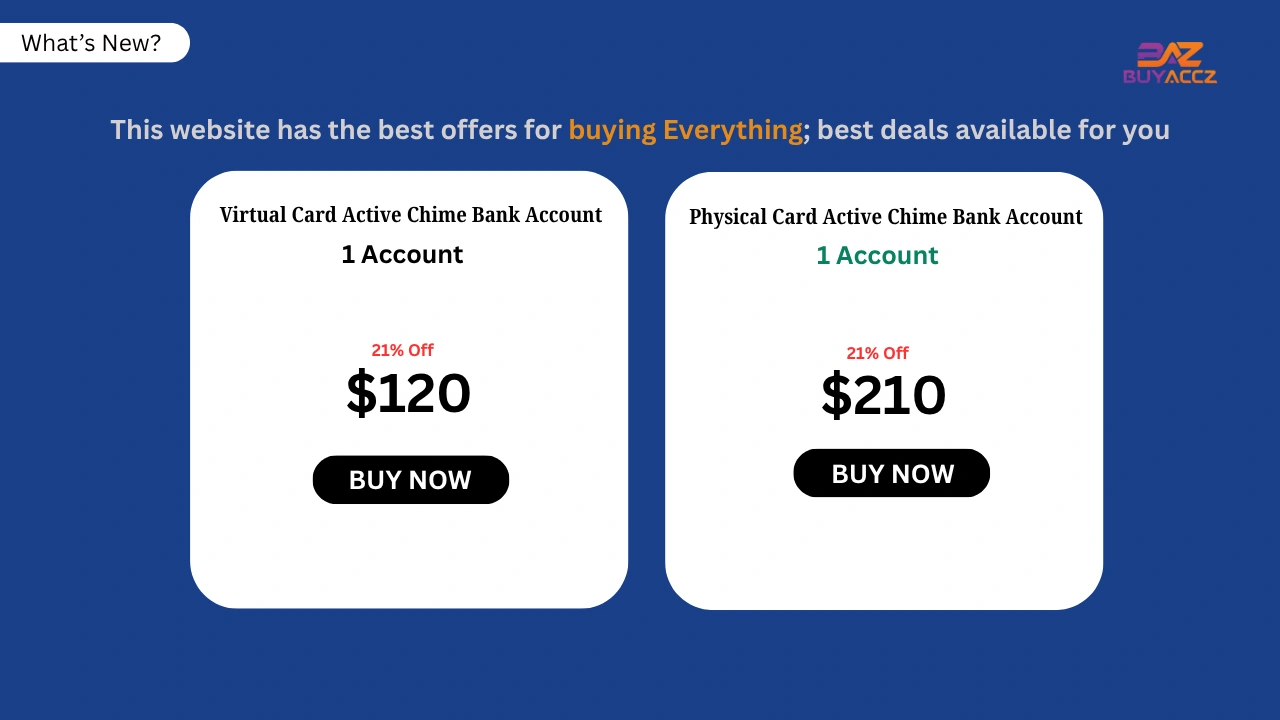

The Chime app makes it simple to take control of your finances, but where can you load your Chime card? You can also load cash at retail locations, including Walmart, Walgreens, CVS, 7-Eleven, and Rite Aid, through the Green Dot network.

At most of these spots, you can hand over cash to the cashier, who will deposit it in your Chime account for a small fee. You can also add money via mobile check deposit, employer direct deposit, or by transferring funds from another linked bank account.

These various options allow you to reload your card at any time, whether you’re in a store, at work, or on the go providing 24/7 access to your money.

Cash Deposit Locations for Your Chime Card

Walgreens: Cash deposits are free and instantly credited. Over 8,000 Walgreens stores nationwide accept Chime cash deposits at the register using your Chime Visa debit card or the in-app barcode.

Duane Reade: Also fee-free if used like Walgreens for cash deposits.

Walmart: Cash deposits available but a fee applies (usually $3.74 or less). Deposit at the Money Center or customer service desk.

CVS: Accepts Chime cash deposits; a fee may apply at most locations.

7-Eleven: Cash deposits are possible but will incur a fee.

Dollar General, Family Dollar, Circle K, Speedway: Cash deposits accepted, but expect a transaction fee.

The Easiest Way to Load Your Chime Card

Deposit Cash at Partner Retailers: Go to places like Walgreens, CVS, or Walmart to ask the cashier to add money to your Chime account at the time of purchase and receive instant balance adjustments with an immediate card swipe and cash handoff.

Transfer From A Linked Bank Account: You can log in to the Chime app or website, enter your other bank account, and initiate the transfer; you will see funds in one to three business days (securely) show up in your Chime account.

Direct Deposit from Employer: Give your employer the Chime account’s routing and account numbers (payroll can be automatic); as a result, you will receive your paycheck two days faster when payment day arrives!

Mobile Check Deposit: Open your Chime app to the “Move Money” and “Deposit a Check” options, then snap photos of the check’s front and back, add details, and you’re done once it is approved. Your balance will be instantly updated with the deposit amount.

Get Transfers from Friends or Family: Your friends and family can send money directly to your Chime account with their bank’s app; deposits arrive within minutes, so you won’t lose any valuable time waiting for a transfer recipient to use

How to Load Money on Your Chime Card for Free

You can add money to your Chime card for free through a few different ways. The simplest way is direct deposit, in which your paycheck, government benefits, or tax return payments go directly to your Chime Spending Account automatically and with no fees.

The Chime app also offers free mobile check deposit (using your smartphone’s camera). Another way is with mobile check deposit using the Chime app. You can also electronically transfer money from another bank account to your Chime account, but it’s usually free, though your other bank might charge its own fees.

For cash deposits, Walgreens and Duane Reade are two places where you can load your Chime card for free if you hand over the cash at the cashier along with your physical card. Other retail stores, including Walmart, CVS, and 7-Eleven, will accept cash deposits but at a cost per transaction. When you transfer money into your Chime account via an online transfer, direct deposit, mobile check deposit, or cash deposit at Walgreens, there are no additional fees.

Can You Load Your Chime Card at an ATM?

It is not possible to add money to your Chime card at an ATM. Cash deposits at ATMs are not permitted. Instead, you can deposit cash for free at over 8,000 Walgreens locations around the country by handing an employee cash and your Chime card at the register; the cashier scans your card or a barcode on your phone in the Chime app to add money directly into your account.

Other retail spots like Walmart, CVS, and 7-Eleven will also accept cash deposits, though typically for a fee. Walgreens is the way to go for low fees, and you can deposit cash. In addition to cash deposits, you can also load your,

Chime card through direct deposit, mobile check deposit, and transfers from an external bank account via the app. Although they’re not a deposit-taking ATM, you can withdraw your money from Chime’s network of over 47,000 fee-free ATMs nationwide.

How to Load Your Chime Card Step-by-Step

Open the Chime App: Open your Chime app and select “Move Money” then “Deposit Cash”. This shows you locations nearby where you can deposit cash into your Chime account using a barcode or your Chime card.

Visit a Retail Partner: Find a Walgreens or other authorized location like Walmart, CVS, and Duane Reade. Show the cashier your Chime card and give them cash (plus any fees you wish to pay). Sometimes this is referred to as a “reload”.

Use the Deposit Barcode: Within our app, select “View Barcode” on the Deposit Cash screen. The cashier scans this barcode and the cash, sending it to your Chime Checking account in minutes to a few hours.

Verify Deposit Limits: You can deposit cash up to three times every 24 hours, with a daily limit of $1,000 or a maximum of $10,000 per month. As proof of deposit, always retain the receipt.

Try Other Approaches: By contrast, there can be several ways to set up direct deposit, bank transfer, or peer-to-peer payment through an app like Cash App or Venmo for immediate or scheduled funding of your card.

Mobile and App Loading Options for Chime Card

You have a few ways to load money on your card from your phone app (deposit cash at a partner retail store using the in‑app barcode, deposit checks with mobile check deposit, and direct deposits). They deposit via an ACH as soon as they receive it into your Chime Spending Account, and this account is connected to the debit card.

In the app, you can visit “Move Money” → “Deposit Cash” to create a unique barcode number that you bring straight to the cashier along with your cash at wherever you wish to deposit it, including Walgreens, Walmart, and CVS. Then the cashier will scan it and hold onto your cash until the transaction processes (nearly always instantly)—although some stores charge a small fee.

You may also use “Move” → “Deposit Check” in the Chime mobile app to deposit checks by taking a photograph and submitting them for deposit, or you can simply arrange for direct deposit of your payroll/benefits (as long as they are not government payments)

So that the money is automatically loaded into your account every payday, and then all loaded funds on your card upon processing should be available for transactions without any additional “card reload time/processing,” with immediate access to spend using your Chime Visa Debit Card.

FAQs

1. Where to load a Chime card?

Deposit cash at any of more than 75,000 retail locations, including Walgreens, Walmart, CVS, and 7-Eleven, with the Chime app or your Chime card.

2. Can I deposit cash at an ATM?

No, cash deposits are not accepted at ATMs by Chime. Cash deposits are only available at retail partners.

3. Do you have to pay to deposit cash?

Deposits at Walgreens are free. Some other retailers may charge a fee, which is displayed in the app before users make a deposit.

4. How Do I Deposit Cash on My Chime App?

Open the app, select “Move Money,” tap “Deposit a Check,” and take a picture of the check on both sides.

5. When will I see my deposit?

The majority of deposits show up in minutes, and some take as long as two hours, depending on the retailer.

6. How many deposits can I submit each day?

You can deposit up to three cash deposits every 24 hours at retail locations.

7. What happens if there’s damage to the magnetic strip on my Chime card?

You are going to have to replace your card, as they do not allow chip or manual entry for cash deposits.

8. Are there deposit limits?

They have a daily limit of $1,000 and a monthly limit of $10,000. Retailers may have lower limits.