Deposit cash to your Chime account at any Green Dot location without a credit check, and enjoy quick access to your funds 24 hours per day at thousands of free ATM locations. Whether it’s direct deposit or your tax refund, the Spending Account offers you several easy ways to add money,

So whether you prefer direct deposits, transfers from other banks, or credit card transfers, give one a try! In this guide, you will learn five easy ways to Add Money to Chime Account with simple steps. Knowing these can save you money and maximize your Chime banking experience.

Take charge of your finances by discovering how to easily fund Buy Verified Chime account and experience the perks of a modern, mobile bank that was built with you in mind.

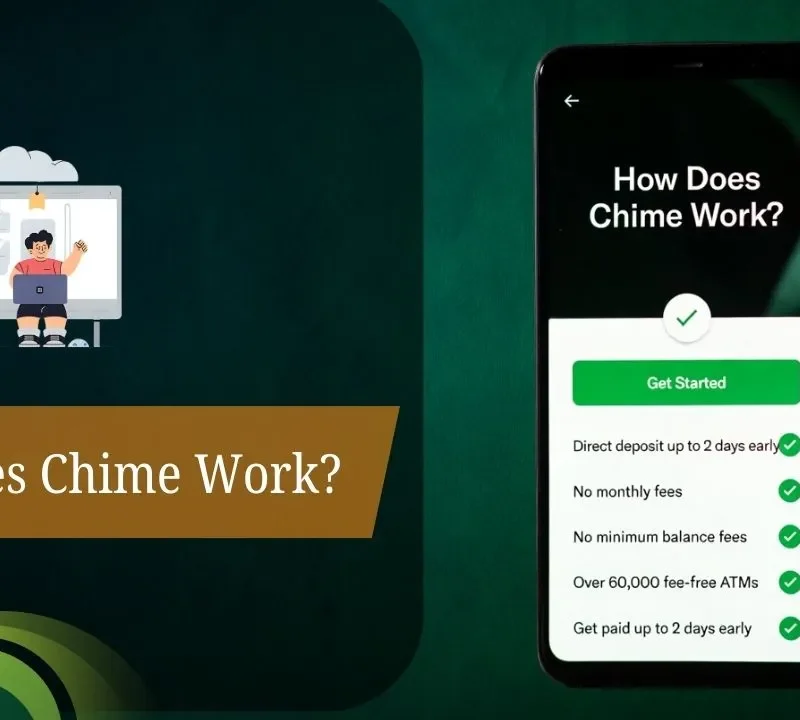

What Is Chime Bank Account

Chime Bank Account is an online checking account provided by Chime, one of the highest-yielding neobank in the US that renders banking services mainly through a mobile app, altogether without any physical branches making it perfect for those looking for inexpensive and accessible banking solutions.

It is notable for fee-free banking, with no overdraft fees or monthly maintenance charges, and instead makes money on interchange fees from debit card purchases. Highlights include fee-free overdraft protection on balances up to $200; early direct deposit for paychecks (up to two days in advance); access to a network of thousands of

ATMs that allows for free withdrawals; savings tools such as Grow Your Savings and the Round Up feature, both of which help foster financial health; and a debit card so you can easily make transactions in person or online all supported by FDIC-insured partner banks like The Bancorp Bank and Stride Bank.

Different Ways to Add Money to Chime Account

Direct Deposit

Have your paycheck or government benefits loaded directly onto your Chime card by setting up direct deposit with your employer or benefits provider it’s simple to do! (Chime provides access to your money 2 days before payday, so this is the most convenient choice.)

Cash Deposits at Retail Locations

Deposit cash at one of 75,000 locations, including Walgreens, CVS, 7-Eleven, and Walmart. Give the cashier your Chime card and cash. Fees usually amount to $5 for deposits, with a limit of $1,000 per day and $10,000 per month.

Mobile Check Deposit

Deposit checks by photographing both sides with the Chime mobile app. Serves for personal, business, and government checks. So long as the check is under $5,000 nationwide. Check Types There are dozens of check types, and a bank’s policy can change over time.

How to Add Money to Chime Using Direct Deposit

For Chime direct deposit, open the Chime app and follow these steps to add money: Tap Move Money; find and tap Set up direct deposit; next to Copy your routing number, tap Copy. You can share that information with your company or payroll provider (such as ADP),

look for your employer in the app for automatic setup, or tap Get completed form to receive a pre-filled PDF via email (which also includes a voided check) to submit. It’s free to use, but you will wait up to 2 pay cycles for

The feature to apply, and funds may post up to two days early, with qualifying deposits of $200+ for Chime+ members unlocking higher savings and priority support. Verify by looking for the first deposit notification inside the app.

How to Transfer Money to Chime from Another Bank

Open the Chime app and navigate to Transfers.

Open the Chime mobile app and log in quickly (and securely) with your details. Tap the “Move Money” tab at the bottom, then tap “Transfer Money” to get to the screen for linking external banks.

Link Your External Bank Account

Then tap “Add External Account” or “Link a New Account.” Chime makes a secure connection through Plaid to your dang account—and all you’ll need to do is search for your bank, input your login credentials, and finalize the link. Check whether the confirmation comes up with tiny micro-deposits.

Initiate and Confirm Transfer

The source will be your linked bank account, and then you must specify the transfer amount and review other details (like up to 5 business days for the money to arrive) before tapping “Transfer” to confirm. Funds arrive securely via ACH.

Alternative Funding Sources for Your Chime Account

In order to do a bank transfer to Chime from another financial institution, you can use the Chime app or your other bank’s online portal. Inside the app, select “Move Money” and then choose “Transfers,” and you will be prompted to link your external bank account by securely entering your other bank’s login information.

After connecting, you can make deposits, with funds generally arriving within five business days in your Chime account. Or sign in to your other bank’s site or app and enter your Chime account using the routing and account number. Verification may be accomplished by checking small micro-deposits.

Once vetted, make the transfer, which typically takes between one and three business days. You can even make instant transfers with a debit card, though there’s potentially a small fee. This is a safe and easy way to transfer money from bank to bank.

FAQs

1. How do I put money on my Chime account?

You can deposit money through direct deposit or using your mobile device to take a picture of the check, make cash deposits at various retail stores, and transfer from an external bank.

2. Does Chime allow cash deposits?

Yes, you can use the Green Dot Mobile App to deposit cash! … Just take your cash and card to the register at one of 90,000+ retailers nationwide.

3. Is there a fee to add cash to Chime?

Some also charge a small fee ($3.95 is common), while others offer it for free or less, depending on store policy.

4. How long does it take for cash deposits to be available in my Chime account?

Most in-person cash deposits are available in your account right away, but some locations can take up to 2 hours.

5. Can you transfer money from another bank to Chime?

Yes, ACH transfer is possible through our partner bank (Chime) account and routing number OR by linking debit cards.

6. Does Chime have mobile check deposit?

Yes, Chime does have the feature of mobile check deposit with its app for certain approved members, although it’s especially good if you’re making direct deposit activity.

7. Can I receive money from someone else on Chime?

Yes, other people can send money to Chime via their Pay Anyone feature or by transferring to your account number from another bank.

8. What is the simplest method of adding money to Chime?

Direct deposit is the simplest and fastest way since it’s free and automatic, and you have early access to your paycheck.