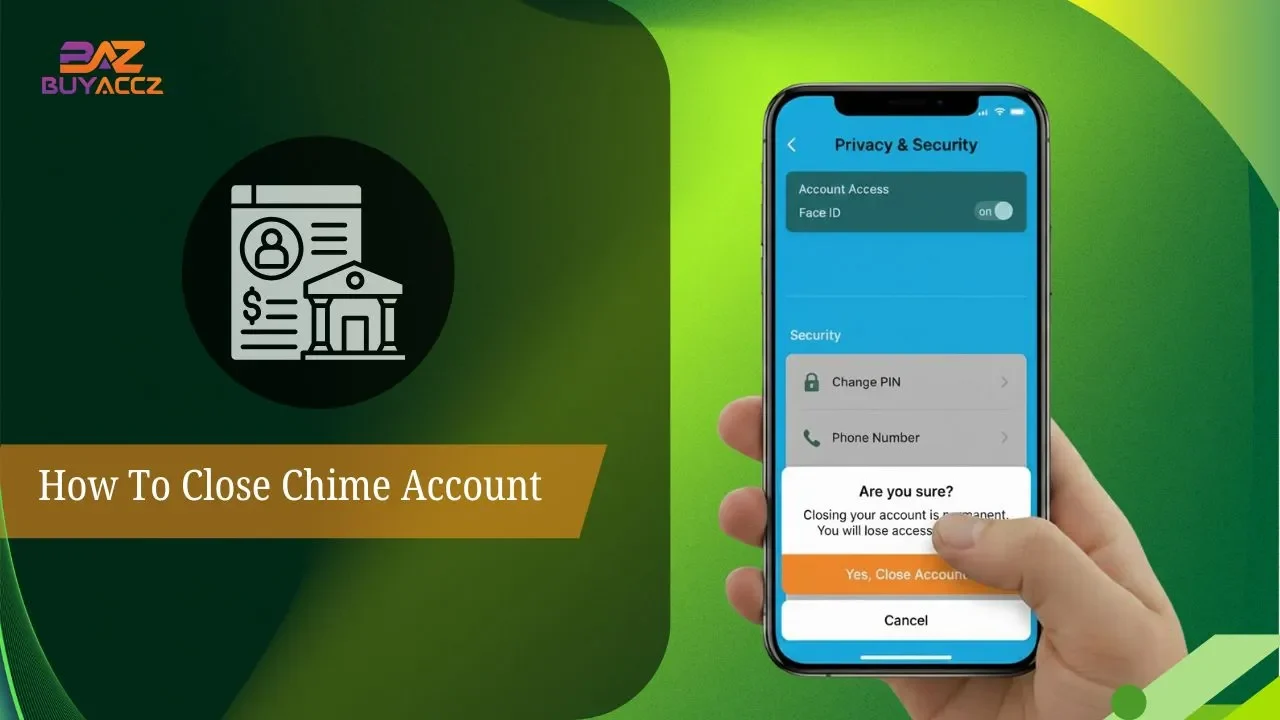

Shutting down your Chime account is a simple process when you know the correct steps. No matter the reason you’re looking to close your Chime account, whether it’s because you’re switching banks or you just no longer have use for the account, this guide will explain exactly how to go through with the process How To Close Chime Account.

Find out what to check for prior to closing, how you can get any money inadvertently left in your account, and make sure that when your account is closed, it stays closed. Your straightforward guide tips for users of Chime will help you steer clear of common problems and safeguard your personal financial details through the process.

Here are some easy steps to manage your Chime account closure responsibly and stress-free so you can remain in charge of your money throughout the process.

What Is a Chime Account?

A Chime account refers to a mobile banking app created by Chime, a fintech startup that works with banks to provide consumers access to FDIC-insured checking and savings accounts. It charges no monthly fees or overdraft fees, requires no minimum balance, and provides access to more than 60,000 fee-free ATMs.

Chime offers early direct deposit, with users able to receive their paycheck up to two days earlier, and a Spot Me service that provides fee-free overdrafts of as much as $200 for eligible account holders. The account offers automatic savings features, such as round-ups, and is compatible with a Visa debit card that is accepted with both

Mobile check deposits and payments to friends or other people; it can also be used in digital wallets like Apple Pay and Google Pay. Users need to be US residents over the age of 18 years, and accounts are opened through the mobile app with funds held in partner banks and additional security measures.

Requirements Before Closing Your Chime Account

Before you close your Chime account, make sure that your balance is zero by transferring funds out and then cancel any associated subscriptions or autopay. Unlink all external accounts connected to prevent problems.

To close your account, open the Chime app and head to Profile > Personal Info > Close Account. Follow the prompts, inputting your verification of identity as well. If you have a Credit Builder account or the option simply doesn’t appear in the app, contact Chime support at (844) 244-6363. All closure requests are handled within 5 working days.

The leftover balance when closed, if any, will be returned by check at your address on record in 14 to 30 days. Download any tax documents or statements you need before closing, because you lose account access after it closes.

How to Close Chime Account Step-by-Step

Prepare Your Account

Cash out or move all money to another bank, with Chime Checking and Savings having a $0 balance. Unlink all attached external accounts, subscriptions, or direct deposits to prevent pending transactions from obstructing a closure. Make sure that there are no negative balances or disputes before you proceed.

Access Closure in App

Open the Chime mobile app and log in securely. Go to Profile, Personal Info, and scroll down to the Close Account option at the bottom. Follow on-screen instructions, and you may have to verify your intention and the last four digits of your Social Security number.

Confirm and Follow Up

Request a closure, and Chime will mail any remaining balance via check within 30 days, if applicable. Support Savings, Credit Builder, or issues—call (844)244-6363 to close. Keep track and wait for the final confirmation email.

How to Contact Chime Customer Support

You can reach out to Chime customer service by calling their 24/7 customer service number at 1-844-244-6363. And you can also find help right in the Chime mobile app by going to Profile > Help Center > Chat, where you can initiate a chat with an agent.

If you have a non-emergency question, they also offer email support at support@chime.com (you must send the message from your registered email address). These options offer fast and secure paths to Chime for account assistance, card issues, or other inquiries related to banking.

Can You Reopen a Closed Chime Account?

User-Requested Closures

If you initiated the closure of your Chime account yourself, support may be able to help reopen it by phone at (844) 244-6363. You’ll need to come into the store for this one, as it’s an over-the-counter type of service.

Chime-Initiated Closures

Chime and its partner banks won’t allow accounts closed for inactivity, fraud, policy violations, or any other reason to be reopened. In either case, the reactivation is permanent, and you will need to ask about opening a new account if it was closed due to inactivity; however, approval for a new account will depend on the reason why you were closed and your relationship history with the bank.

- Call Chime support ASAP at (844) 244-6363 with your ID and account information to verify the reason for the closure.

- Collect any previous statements and a government-issued ID for identification purposes.

- Look at Chex Systems or credit reports for other flags that could inhibit new applications.

FAQs

1. Can I close my Chime account from the app itself?

Yes, but you’ll need to reach out to Chime support, as the app doesn’t have a native “Close Account” button.

2. What if I take the same question and apply it to Chime?

Get your money out, deal with any pending transactions, and download whatever statements you require.

3. How long does it take to close the Chime account?

It would almost always be 2-3 business days later when the support comes in.

4. Can I reopen a Chime account after closing it?

No Chime has no reopening fees, so if you had to close your account and want Chime again, there is no need to reopen your old account.

5. What is the Chime account closure fee?

There are no account closure fees at all with Chime.

6. What will happen to my direct deposits when I close my account?

They are just going to be sent back to the sender, so make sure you let your new bank know before it materializes.

7. How can I reach Chime to close my account?

Chime offers in-app chat and email (support@chime.com) or phone support.

8. Will closing my Chime account hurt my credit?

No, Chime is not a credit account, and closing it does not affect your credit score.