Cash App accounts provide consumers with a safe and easy way to send, receive, and save money. Do everything from splitting checks to giving loans, or pay anyone with a text; Trade Bitcoin and stocks in the app (Bitcoin trading offered by Cash App);

Fast access to your balance without having to log into your accounts directly from the phone. It takes just a few minutes to create an account when you link your debit card, verify your identity, and unlock features such as the customizable

Cash Card, direct deposits for paychecks up to 2 days early, and Boosts for instant discounts. In this guide, learn how to set up, secure, and maintain your Cash App account for daily use.

What Is Cash App Account?

A Cash App account is basically the digital equivalent of a wallet, as it’s used exclusively for sending and receiving money over its payment network: The app is free; users must download the app to create an account,

Which requires their name and provides options for verifying identity, opting to sign up if they are 13+, or granting full features if age-verified (age verification is available for those 18+). Key features include a unique $Cashtag for transferring money to others, funding accounts using a bank account or debit card, and spending the,

Cash App balance directly from a web or mobile device or with the optional Cash App Card at retailers. Other benefits include early paychecks with direct deposit, high-yield savings, stock and Bitcoin investments, and tools for businesses.

How to Verify Your Cash App Account

Access Profile and Start Verification

Launch the Cash App on your device and tap the profile icon found in the top-right corner. Scroll down to “Security & Privacy” and choose “Verify Identity” from the connected identity verification section with your personal information to start. This sets in motion safe and secure identity verification, where basic information such as a name and birthdate can be used to perform initial checks.

Enter Personal Information

Enter your full legal name, date of birth, and last 4 digits of your SSN as requested. Cash App might ask for your full SSN, specific information about where you live, or other details; if so, put those in correctly. All data is encrypted with the highest standards and transmitted securely to avert fraud during compliance.

Submit ID and Selfie for Verification

Submit a government-issued photo ID (such as a driver’s license) and take a selfie in the moment for facial comparison. Wait for review (24-48 hours); status can be verified in Security & Privacy at “Verified.” Once you’re approved, verification gives you access to conveniently raised limits and full use of the site.

How to Add Money to Cash App

Link Bank Account

Open Cash App, tap the profile icon in the upper-left corner, and then select “Banking” or “Linked Accounts.” Provide your bank routing and account number or debit card information, and verify instantly by micro-deposits if desired. This is a more secure way to add your funding source.

Access Balance Screen

Tap the dollar sign or “Money” tab in the bottom center of your home screen to see your cash balance. If nothing, then we will continue; otherwise, keep the appropriate point. This takes you straight to the add funds screen.

Add Funds and Confirm

Tap “Add Cash” or the plus icon, enter an amount ($10-$200), tap “Add,” select your linked bank, and confirm with PIN or Touch ID. There’s no wait time for funds to show up, and credit cards don’t charge fees.

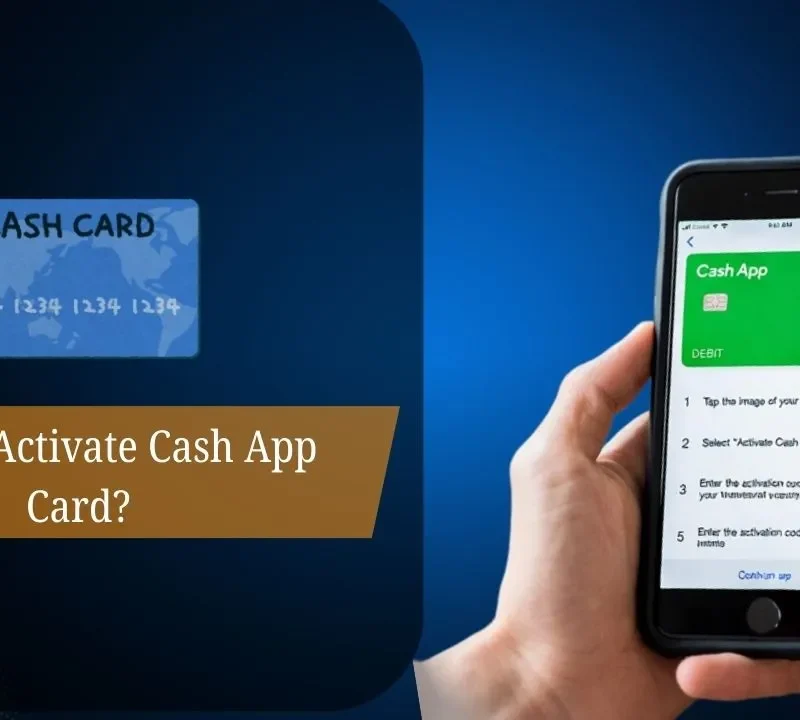

How to Use Cash App Card

The Cash App Card is a free, customizable card that allows you to pay online and in stores or even withdraw cash from ATMs without being connected to your bank account. Order direct from the app’s

Cash Card tab by tapping “Get Cash Card,” customise if you’d like, then confirm free shipping no credit check necessary. They’ll be able to start using the card as soon as they activate it by scanning the QR code on the card or entering its CVV digitally in-app. Link a debit card or bank account in profile settings, and use “Add Cash” for same-day transfers (credit cards accepted, but they charge additional fees).

Use swipe, tap, or a dip to access funds and make everyday purchases; check your balance after each transaction in-app. Cash out to bank accounts instantly and fee-free with standard transfers using the “Instant” option (unfortunately does not apply to credit cards).

How to Use Cash App for Online Payments

Setup Requirements

Download Cash App from your app store, then create an account with your phone number or email. Connect a debit card or bank account in order to fund your investment, and you can do so instantly from your bank or from retail deposits. Use security settings such as a PIN or biometric ID for transactions.

Online Payment Steps

Choose Cash App Pay when you are at a merchant checkout, either via mobile or desktop. On mobile, the site redirects to Cash App for Account you to confirm with your balance or approved card; on desktop, you scan the QR code that the service provides using your phone’s camera or app. Follow the prompts to authorize your payment, which first takes funds from your Cash App balance if you have enough money in the app to cover it.

Key Limits and Tips

Transactions are used from your stored balance or debit card, but there are no combining methods per order. Monitor activity on the feed in the app, but statements might not list them separately. For wider spending, a $2 order of the free Cash App Card is eligible for Visa debit purchases or digital wallets such as Apple Pay. Double-check your recipient so there are no errors in peer-to-peer sends.

FAQs

1. What is Cash App, and how does it work?

With Cash App, you can send and receive money, as well as invest in stocks and buy Bitcoin.

2. How do I sign up and verify my Cash App account?

You can download the app, sign up, and verify your identity with some basic information.

3. How do you use Cash App to send and receive money?

Enter the amount, select a contact, and tap Pay or Request.

4. Is Cash App safe to use?

Yes, it practices encryption and security to ensure the safety of its users.

5. Do Cash App and Venmo have options for adding or withdrawing money?

Connect a bank account or card to deposit or cash out funds.

6. Does Cash App charge fees?

Standard transfers are free; instant deposits may have a fee.

7. Can you use Cash App with a debit card or bank?

Yes, you can connect both for deposits and withdrawals.

8. What if a payment doesn’t go through or is pending?

Verify your balance, connection, or contact Cash App support.