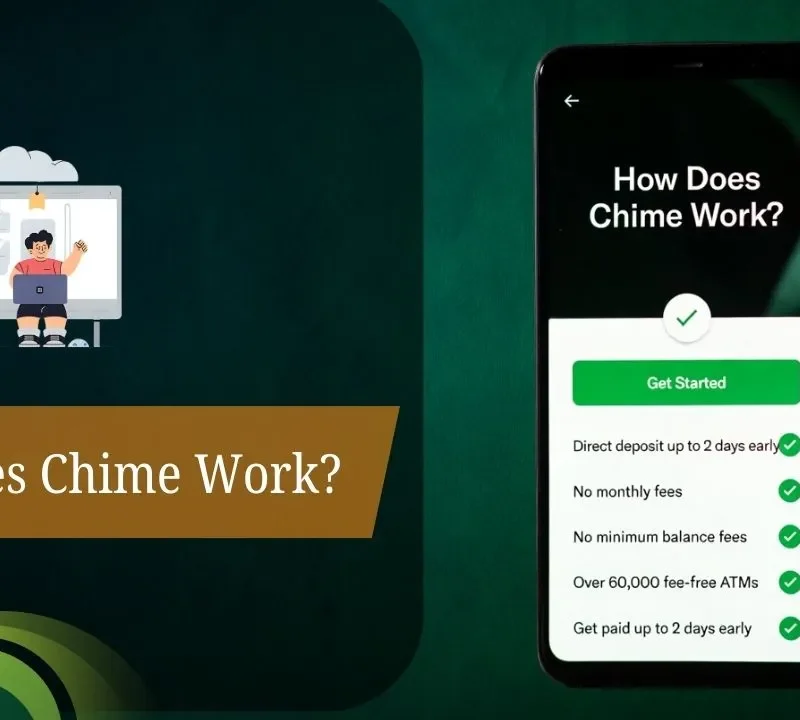

Chime is radically changing the way millions of people bank with its award-winning mobile app (iOS, Android), free no-overdraft-fee bank accounts, and micro-saving Chime Accounts features that help members manage their money easily and stress-free.

Established in 2012 by Chris Britt and Ryan King in San Francisco, this top neobank provides FDIC-insured checking accounts and savings accounts thanks to partners such as The Bancorp Bank, no overdraft fees, as well as early access to direct deposits up to two days ahead of schedule.

It has some great features as well, like SpotMe overdraft protection up to $200 and high-yield savings at 2.00% APY—but that’s not all: They’ve got instant peer-to-peer transafers and real-time alerts when you spend to help keep your budget in check.

What Is Chime Accounts

Chime accounts are offered by Chime, a financial technology company; Chime itself is not a bank, but it partners with FDIC-insured institutions such as The Bancorp Bank and Stride Bank to provide banking services.

Key innovations include a no-monthly-fee checking account with a Visa debit card, early direct deposit up to two days earlier, SpotMe for fee-free overdrafts up to $200 if eligible, and free ATM access at over 60,000 locations. The Yes! High-Yield Savings Account comes with automatic savings features and competitive APYs (for example, up to 10% for Chime+ members), as well as no overdraft or foreign transaction fees.

The entirely mobile-based management of features, including peer-to-peer payments, cash deposits at retailers (up to $1,000 per day), and ACH transfers within their existing external bank accounts, has Chime primarily earning money from debit card interchange fees.

Does Chime Make Money From Fees?

It doesn’t make most of its money from customer-facing fees. It makes more than 72% of its revenue from interchange fees merchants pay to Visa every time you spend money swiping a Chime debit card, providing customers with an experience of truly fee-free banking.

Secondary income from out-of-network ATM fees ($2.50 per withdrawal, historically 21 percent), as well as interest on deposits, pales in comparison to interchange earnings. Chime banks on purpose not charging any overdraft, monthly maintenance, or minimum balance fees to lure and keep users.

Chime’s Q1 2025 marked its first profitable quarter, with Chime processing $121 billion in transactions annually from 22 million customers who made between 40 and 50 transactions a month per user. This high-volume business model maximizes interchange revenue for Chime.

How Chime Makes Money Without Charging Customers

Interchange Fees

Chime earns primarily from interchange fees, where merchants pay a small percentage (around 1-2%) per debit/credit card swipe via Visa networks—about 72% of total revenue. This incentivizes everyday spending without user costs.

Optional Tips and Fees

Users voluntarily tip for SpotMe overdraft protection or opt into small fees ($2–$5) for instant paycheck advances like MyPay, plus out-of-network ATM charges that are avoidable.

Partner and Credit Products

Revenue supplements from bank partners (Bancorp, Stride) and no-interest Credit Builder cards that boost usage, scaling with active accounts rather than loans or debt.

How Chime Makes Money Without Interest

Chime, a leading neobank, generates revenue without relying on interest from loans or deposits, unlike traditional banks. Its primary income source—over 72% of total revenue—comes from interchange fees on Visa debit card transactions.

Every time users swipe their Chime card at merchants, Visa collects a fee (typically 1-3%), and Chime receives a share, incentivizing high transaction volume without user charges. Additional streams include optional user tips on features like SpotMe (overdraft protection) and MyPay (instant payroll advances with $2–$5 opt-in fees), plus minor out-of-network ATM fees.

Chime partners with Bancorp and Stride Banks for FDIC-insured deposits but avoids lending spreads. This fee-free model has fueled 12+ million users, focusing on healthy spending over penalties, with potential future credit products on the horizon.

Chime ATM and Cash Deposit Revenue

Chime generates revenue from ATM fees primarily through out-of-network withdrawals, where it charges users $2.50 per transaction on top of any operator fees, contributing about 20-21% of total income as of recent reports. This model supports access to over 60,000 fee-free ATMs via networks like MoneyPass and Allpoint but penalizes usage outside them to boost profitability while marketing as low-fee banking.

Cash Deposit Mechanics

Chime enables cash deposits at participating retailers like Walgreens and Walmart via barcode scanning, with fees up to $4.95 per deposit collected by merchants and shared via partnerships, indirectly fueling Chime’s platform revenues estimated at $397 million in 2024. This feature promotes liquidity without traditional branches, aligning with its neo bank efficiency.

FAQs

1. Does Chime charge monthly fees?

No, Chime does not charge monthly maintenance fees.

2. How does Chime earn revenue without fees?

Chime makes money primarily from interchange fees on debit card transactions.

3. What are interchange fees?

They’re small fees paid by merchants when customers use Chime debit cards.

4. Does Chime make money from overdrafts?

No, Chime does not charge overdraft fees.

5. Does Chime earn interest on customer deposits?

Yes, Chime earns interest by holding deposits with partner banks.

6. Does Chime charge ATM fees?

Chime doesn’t charge ATM fees, but out-of-network ATMs may.

7. Does Chime make money from loans or credit products?

Yes, products like Credit Builder can generate indirect revenue.

8. Is Chime profitable?

Chime focuses on growth, with profitability driven mainly by card usage.