Yes, users can have two Cash App accounts, but they must adhere to certain rules. For both personal and professional purposes, many Cash App users oversee several accounts. Nevertheless, every account needs to be linked to a distinct bank account, phone number, and email address. We’ve broken down important details for anyone wishing to efficiently manage multiple Cash App accounts below.

How Many Cash App Accounts Can You Have?

Although it is technically possible for Cash App users to have two accounts, each one requires unique login credentials. Every Cash App account requires a unique phone number, email address, and bank account. Since the app uses your phone number and link debit card for account verification and fraud detection, you cannot use them for more than one account.

Have Questions? Contact Us Anytime!

📨 Telegram: @buyaccz

📱 WhatsApp:

1. One Account Per Email and Phone Number

You must use distinct phone numbers and email addresses when creating two Cash App accounts. Customers of Cash App frequently encounter verification problems if they attempt to use the same information twice. Secure money transfers and smooth Cash App Pay transactions are ensured by having distinct login credentials for every account.

2. Separate Linked Bank Accounts Are Required

You need to connect each verified Cash App accounts to a different debit card or bank account. The app needs distinct payment methods for each account to process payments properly, regardless of whether you use a Bancorp bank n a or Sutton Bank card. This keeps your Cash App balance secure and helps avoid mistakes.

3. Using Different Devices Is Optional

Using distinct devices for distinct Cash App accounts can reduce login problems, though they are not required. To ensure continued access, please remember your login information for each account when logging out and switching accounts within the same registered trademarks app. If you’re cautious when logging in, the app makes switching smooth.

Reasons Users Create Multiple Cash App Accounts

Verified Cash App users might want a second account for various reasons, like budgeting, separating business and personal finances, or managing different sources of money. Creating two accounts helps organize payments and purchases and keeps cash balances clearly divided for better money management.

Many people open one a verified Cash App account for personal use and another for business transactions. This helps users track purchases, fees, and payments made to or from select merchants. It’s especially useful if you use Cash App Investing LLC for business-related investment or payment purposes.

With two accounts, users can better manage savings, direct deposits, and everyday spending. You might link one debit card for recurring bills and another for entertainment or food purchases. Cash App customers often separate money this way to avoid overspending or unexpected commission fees.

Risks of Having Two Cash App Accounts

Although Cash App makes it simple to have two accounts, it poses some risk. Handling multiple accounts poorly can result in login problems, late cash app payments, or even getting banned if a term of service is breached. Remember to only leverage every account responsibly to safeguard both your data and money.

Risk of Account Suspension

Should you attempt to use the same phone number, email, or linked bank account on both accounts, Cash App’s fraud-preventing technology will likely identify your double accounts. The service can simply suspend your account if it looks like you are trying to skirt limits or abuse the service.

Confusion and Missed Transactions

Switching between accounts on a single device can result in sending money from the wrong account or not receiving a direct deposit. Before sending payments, checking your Cash App balance, or conducting any other transactions, double-check which Cash App account you’re logged into.

Customer Service Limitations

It makes it harder to communicate with support since you have two accounts. In the event of a missed payment or compromised debit card, you might get mixed up on the information you’re using for which account. Do be sure not to let phone numbers and payment methods get out of hand either, as you will need to match them up come support time.

How to Set Up a Second Cash App Account

Creating a second Cash App account is easy, but you will need to follow all of the steps in the order listed. To begin, log out of your current Cash App account. Then sign up your second account with a new email address, phone number, and bank account, and start sending or receiving money.

step 1: Log Out from Previous Account First

To open a second account: To receive a $5 bonus, first sign out of your existing Cash App account before opening a new one. Tap your profile icon at the bottom-right corner of the screen, scroll down, and choose “Sign Out.” When signed out, the welcome screen will appear, where you can register a different account with new details.

Step 2: Use New Contacts & Bank Info

When registering the new verified Cash App account, use a different email address and phone number than the one associated with your first account. Add a new debit card or bank account, be it Synchrony Bank or any other banking organization, to enable in-app payments and transactions.

Managing Multiple Accounts Effectively

It takes astute management to use two Cash App accounts successfully. Preserve distinct financial records, keep credentials secure, and refrain from combining information. Using multiple accounts can streamline money management, but only if users understand how to use the app and services sensibly.

Using a password manager to safely store login credentials for every account is a smart idea. Make sure both sets of credentials are readily available for seamless account recovery and continued access, as the app requires verification via phone numbers and emails.

Monitor your cash app balance on both accounts closely. Develop the practice of keeping an eye on your Cash App Pay activity, Bitcoin transfers, and payment history. This makes sure you don’t miss any payments from related accounts or direct deposits and helps you identify mistakes fast.

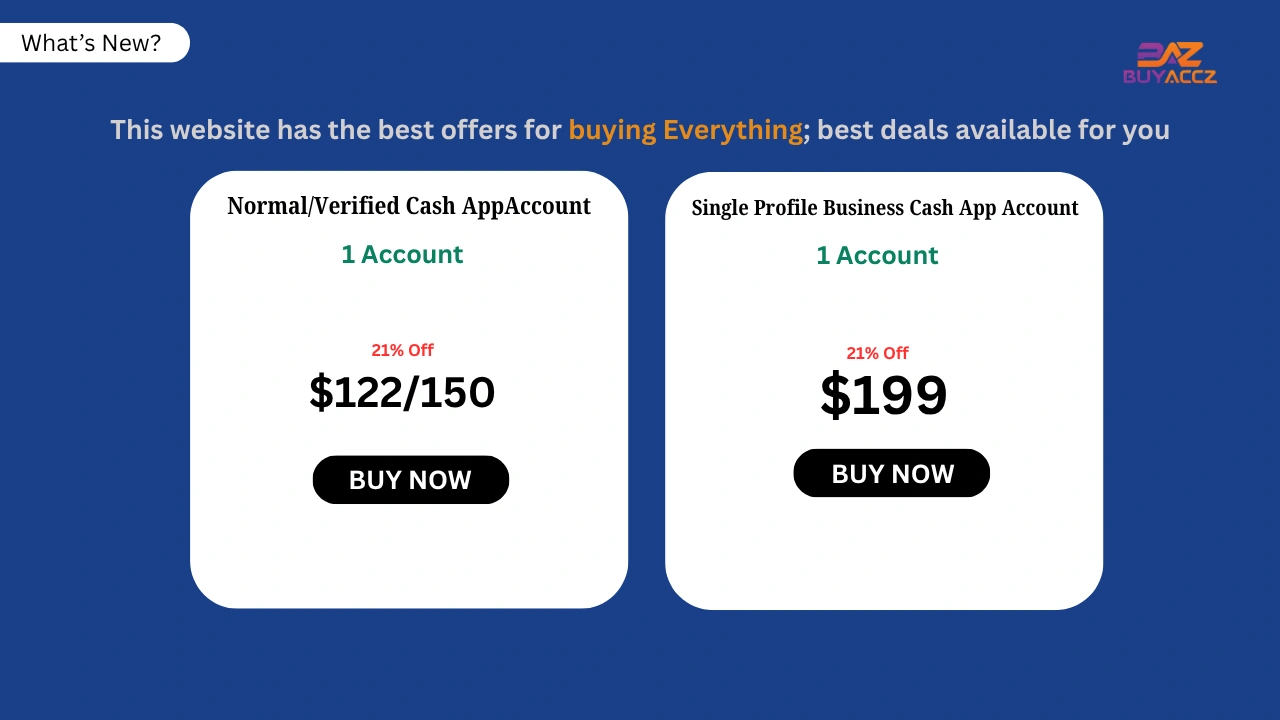

Alternatives to Managing Two Cash App Accounts

If handling two separate Cash App account for sale seems too much to handle, then you probably have no other option. You could use a Venmo account, a PayPal balance account, or a bank app with superior multi-profile capabilities. These services could provide flexibility and choice beyond sign-in and associated accounts.

-

Use PayPal or Venmo for Additional Flexibility

A PayPal or Venmo account allows users to hold funds for a single email address without needing to create multiple accounts. They integrate beautifully with debit cards and have competitive fees for sending or receiving money.

-

Include Banking Apps with Budget Functions

Synchrony Bank and Bancorp Bank N.A. may have you covered with some apps that include budgeting tools, eliminating the need for extra accounts. Some apps allow you to “bucket” your savings or track where you spend money without the need to open various login screens.

-

Set Up Sub-Accounts with Money Management Tools

Several mainstream apps and fintech platforms allow users to create subaccounts, or multiple balances under one account. And they may provide services, like a cash card, fraud protection, and discounts from certain merchants without requiring two separate accounts or logins.

FAQS

1. Can I have two Cash App accounts with the same phone number?

No, each Cash App account must be linked to a unique phone number and email. You can’t use the same number across multiple accounts.

2. Can I link the same debit card to both Cash App accounts?

No, Cash App only allows one debit card per account. To create a second account, you need a different bank account or card.

3. Is it legal to have two Cash App accounts?

Yes, it is legal and allowed. Many Cash App users have two accounts for personal and business purposes, as long as each is set up properly.

4. How do I switch between two Cash App accounts?

Log out of one account in the app, then sign in with the other’s credentials. Each account should use different phone numbers and emails.

5. Can I use two Cash App cards for two accounts?

Yes, each Cash App account can have its own Cash Card, linked to its individual cash app balance and account settings.

6. Will having two Cash App accounts affect my credit score?

No, Cash App accounts are not credit accounts. They do not impact your credit score or require credit approval for use.

7. Can I receive a direct deposit in both Cash App accounts?

Yes, both accounts can receive direct deposit if each is properly set up with a linked bank account and routing number.