See what a Chime account can bring to your financial life—the best way to bank without dealing with traditional banks! Chime is a fee-free online bank that offers a checking account with no monthly fees, no minimum balance requirement, and access to more than 38,000 fee-free ATMs while also providing direct deposit two days early.

Take advantage of features such as Spot Me overdraft protection up to $200, high-yield Chime savings accounts, automatic savings programs, and a user-friendly mobile app for convenient money management, P2P payments, and easy transfers at ATMs across the country.

Perfect for those who want to bank on the go, this account lets you divide your money as you wish between an interest-bearing Save Account and checking with no fees or minimums and withdrawal at 38,000+ fee-free Money Pass ATMs.

What Is Chime Account Verification?

Chime account verification is very important for security reasons; it’s the process of confirming a user’s identity to enable the use of various features such as sending money on Chime, having a debit card, or receiving direct deposits on Chime.

Users first open the Chime app or website, fill out personal information like full name, date of birth, and address, and upload a government-issued photo ID such as a driver’s license or passport. The automated service verifies identities and often approves transfers instantly, but it may require another action, like a selfie, facial recognition, or proof of address, if something appears to be amiss.

This anti-fraud step compares the submitted information with documents, prevents the use of a P.O. box, and also requires a valid Social Security number. Success results in an email with confirmation and immediate access; failures can be resubmitted, or there is a support contact. All in all, it is safe banking within regulations.

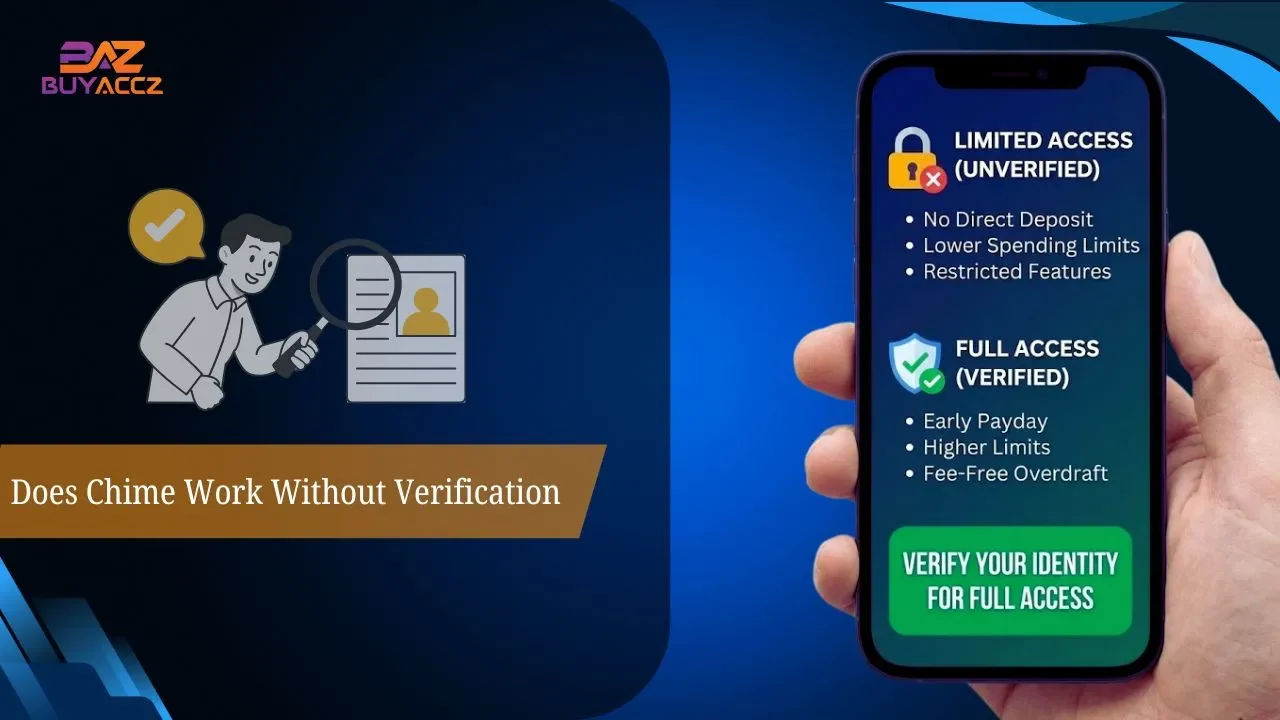

Can I Use Chime Without Verification?

Requirements

Chime requires a valid SSN, U.S. mobile phone number, and U.S. residential address to open an account and use the Service, as well as being at least 18 years old as a U.S. citizen or legal resident. These actions are intended to comply with U.S. banking laws, such as the Bank Secrecy Act. Without them, applications are rejected in identity checks against public records.

Signup Process

You can start just by downloading the Chime app or going to chime.com to register with your name, email, phone, SSN, and address correctly. Verification is done automatically, although you could be requested to upload photo ID (e.g., driver’s license or passport) if problems occur. Make sure your information is correct to avoid delays, as only one account per person is permitted.

Limitations Without Verification

Simple signup may get you started, but essential features such as deposits, transfers, or using a debit card are locked until verified. Requires ID or driver’s license for telephone/email confirmation, which takes 20 minutes. And you can also reach out to Chime support by calling the number (844) 244-6363 if the verification is not successful.

How Chime Verification Works

Chime authenticates users via a machine-powered protocol where you have to type in your name, date of birth, home address, and Social Security number to abide by banking laws and combat fraud. This data is immediately cross-referenced with public records and identity vaults to verify that the user is eligible and who they say they are.

Users are required to take a photo of a valid government identification (ID) and a selfie or video proof for facial recognition in case the automated system is unable to verify the account. Verification can be proof of your address as well. Users get confirmation codes via SMS or email for verification of details.

This is part of verifying the account and allows full use of all Chime Account features, such as banking with them, keeping your account secure, and meeting regulations. If problems occur during the process, support is available, so good documentation and quick communication are key for a flush experience. It generally takes minutes to days for the above process, depending on the verification route.

Steps to Verify Your Chime Account

- Enter your Chime account by signing in with your username and password when you opened the account.

- Go to account settings, or the section that manages profile settings, which is usually accessible by tapping on your name or profile picture.

- Look for the “verify” or “identity verification” option and click on it to start.

- Get your necessary documents in order, typically a valid government-issued photo ID (driver’s license, passport, or state ID) and maybe even proof that you live where you say you do (a utility bill or bank statement).

- Clear photos of your identification card must be uploaded so that all the text is visible, including the whole ID document.

- If required to do so, perform any other verification procedures (a selfie or face recognition) as requested. This assists Chime in verifying if your identity matches the documents provided.

- Upload your verification and wait for approval, which usually takes a few minutes to 2 days.

- You’ll get a confirmation email or notification—and access to all your Chime account features.

Why Chime Requires Identity Verification

Chime needs ID verification to comply with U.S. federal banking laws, such as know your customer (KYC) rules, under which financial companies must verify the identity of customers in order to prevent fraud and money laundering.

Upon signing up, people need to enter their full legal name, date of birth, residential address, and Social Security number (SSN), which is then cross-referenced against public records by automated third-party systems in order to ensure the user is at least 18 years old. That step also adds a security layer, such as fraud monitoring, app-based authentication like Face ID or fingerprint, and other features like higher spending limits or SpotMe once you’re accepted.

Most verifications are instant with no additional documents, but manual steps such as submitting photo ID, selfies, or proof of address may occur if necessary, focusing on immediate public access without sacrificing the safety necessities.

FAQs

1. Do I have to verify my identity if I want to use Chime?

No, Chime needs to know your identity before you can use the Chime Card and start sending money with Pay Friends.

2. What if my Chime verification is still pending?

You still can access some of your account functions, but full banking services remain unavailable until you prove to the bank who you are.

3. Does Chime provide you with a temporary account while waiting for the full account to be verified?

Yes, you can sign up for Chime, but before you’ll be able to use it as you normally would, the platform requires that you verify your ID.

4. Can you get direct deposits on Chime without it being set up?

No, direct deposit is enabled only after proper verification of identity.

5. What is Chime asking for verification for?

Chime is a follower of the federal regulations of banking (KYC), and they are needed to identify and verify the identity of all their customers for security and fraud protection purposes.

6. What do I need to activate or verify my Chime account?

A valid government ID and SSN are needed for personal info.

7. How long does it take for Chime to verify identity?

Just a few minutes, but sometimes it may take up to 24 hours.

8. What if Chime can’t confirm my identity?

Chime can ask for more documents or restrict your access to your account until they’ve fully verified who you are.