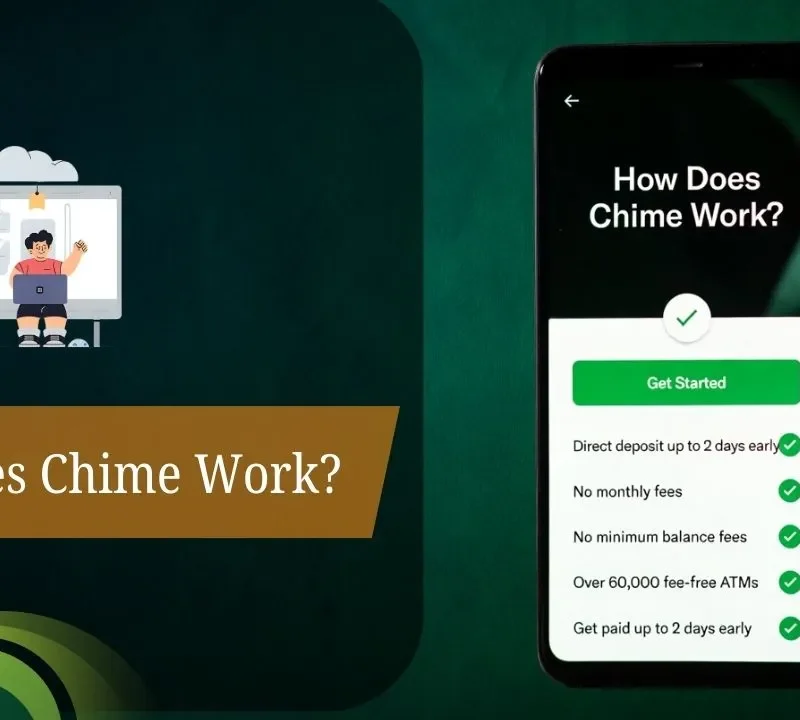

Experience the new way to bank online with your digital Chime account today. Signing up for a new Chime account is quick and easy, with no credit checks, no minimum deposits to worry about, and access in an instant with the Chime app.

Take advantage of our standout Chime banking features, including early direct deposit (up to 2 days earlier), automatic savings tools, and the opportunity to get paid up to 2 days faster with Direct Deposit3. Have an optional Chime SpotMe limit of up to $2004 toward overdrafts. Great for everyday banking, Chime offers online savings accounts with high-yield APYs and no hidden fees.

Whether you’re establishing credit with the secured Chime Credit Builder card or saving money on monthly fees, an award-winning Chime account makes it easy to complete almost any banking task from your phone and keeps you in control.

What Is a Chime Account?

Chime, which is a popular online banking service but doesn’t operate like a traditional bank, provides fee-free checking and savings accounts from FDIC-insured partners such as Stride Bank and The Bancorp Bank.

With your main Spending Account, you have the option of using it as an everyday account with a Visa Debit Card; for purchasing online or in-store, paying bills, and withdrawing cash fee-free from ATMs throughout the U.S. (at over 60,000 locations). Notable features include SpotMe,

Which offers up to $200 in fee-free overdraft protection, early direct deposit of paychecks (by up to two days), and real-time transaction alerts through the mobile app. The high-yield Savings Account also allows you to automate your savings by rounding up purchases or transferring a portion of your paycheck.

How to Open a Chime Account?

Requirements

Applicants must be 18 or older, a U.S. citizen or legal resident, and provide a valid Social Security number, a U.S. mobile phone number , and a home address within the United States. More proof may involve an unexpired photo ID such as a driver’s license, state ID, passport, or permanent resident card. Individuals can have only one personal checking account; joint or business accounts are not available.

Steps to Sign Up

Download the Chime app from the App Store or Google Play. chime. com and click “Sign Up.” Fill in your first-middle-last name, email, phone, DOB, address, SSN & check to make sure everything is accurate , then create a password. If requested, submit clear pictures of your ID so they can confirm you are who you say you are; the process is often instantaneous.

Post-Signup Actions

Choose a Chime Visa Debit Card or Credit Builder card (a digital card can be used immediately for online purchases). Fund the account with an instant transfer, set up direct deposit (found in app settings), or move money from a linked bank account to begin using features like fee-free overdrafts with SpotMe (once you qualify to use it). In the event of issues such as verification failures, contact support by calling (844) 244-6363.

How does the Chime Savings Account work?

Access to the Chime Savings Account is also available; this is a fee-free, high-yield savings account that’s tightly linked with your Chime Checking Account – you can earn up to 3.75% variable APY for eligible Chime+ members who have direct deposits of $500 or more into thei Interest is calculated daily and allocated at the end of each month.

No minimum balance is required, and funds are still FDIC-insured up to $250,000 through partner banks. Open it directly in the app from your home screen, name custom savings goals, and move money between Checking and Savings accounts. Or make cash deposits from stores and merchants like Walgreens first to Checking.

Automate savings with Round Ups round up your debit purchases to the nearest dollar, or Save When Paid, and automatically save 10% (it’s customizable) of each direct deposit over $1. To use, you must transfer money to Checking for spending, ATM withdrawals, and Credit Builder while the account balance (s) remain in Savings.

How Does Chime Get Paid Early?

Open Chime Account

Open an account with Chime through the app, and you automatically have access to early direct deposit (and there’s no additional setup required). Give basic information such as SSN for verification, then activate instantly to get ready for pay access up to 2 days faster than traditional banks.

Set Up Direct Deposit

Find your Routing and Account numbers in the Chime app under Settings > Direct Deposit. Share them with your employer or payroll provider to have your paychecks deposited directly, including gig work earnings as well as salary and benefits payments.

Receive Funds Early

Chime will process incoming deposits as soon as they arrive, up to two days earlier than your specified pay date, skipping bank holds on weekdays. Notifications get sent as soon as funds are in, Monday-Friday.

How does Chime Direct Deposit work?

Chime direct deposit is a type of money transfer that allows you to receive income, benefits, and other types of payments into your Chime spending account directly from the payer via ACH (Automated Clearing House).

To get going, access the Chime app, go to Move Money > Set up direct deposit, and you’ll be able to view your routing and account numbers as well as a pre-filled downloadable form that you can hand directly to your employer (or send via email). Share this information with your employer or payer via their payroll portal, HR payee, or form (including deposit amounts, whether full or partial).

The setup can take place in one to two pay cycles. Money typically comes in by midnight or 9 a.m. on payday, and Chime goes even further with its Early Pay Day feature, providing access up to two days ahead based on when the payer begins processing.

FAQs

1. What is Chime? How does it work?

Chime, a fintech company that delivers banking services through online and mobile apps, charges many of the same traditional fees that banks charge.

2. Is Chime a bank?

No, Chime is not a bank but works with banks on its digital products.

3. How do you sign up for a Chime account?

You can open an account online with Chime by downloading the app and connecting your identity.

4. How does Chime make money?

Chime makes money from interchange fees when you use your debit card, not monthly fees.

5. How does early direct deposit work for Chime?

Chime pays your paychecks when it gets them, usually up to two days early.

6. Is Chime safe, and is it FDIC insured?

Yes, funds are insured by the FDIC up to $250,000 via Chime’s partners banks.

7. How does Chime SpotMe work?

SpotMe enables qualified users to overdraw their accounts in small amounts without fees.

8. Does Chime let you get cash?

Yes, you can take cash out with no fee at more than 60,000 in-network ATMs.