The world of online banking is growing fast, and people want convenience more than ever. Chime is one of the most trusted platforms today, offering safe online banking, no hidden fees, and quick transactions. But what happens if someone wants to send you money through Chime and you don’t actually have a Chime account? That’s where the question arises: How to receive money from Chime without an account? While the process isn’t always straightforward, there are multiple ways to get your money, and sometimes it may even encourage you to open verified Chime account later for smoother transactions. In this guide, we’ll explore your options step by step, while also showing why many people decide to buy verified Chime accounts for long-term benefits.

Have Questions? Contact Us Anytime!

Telegram: @buyaccz

WhatsApp:

Can You Really Receive Money From Chime Without an Account?

Many people think you must have a Chime bank account to get paid, but the truth is you can still receive funds in a few indirect ways. If someone tries to send you money, you can claim it through Chime’s Pay Anyone feature, or you can link a debit card to withdraw funds directly. But if you want access to features like instant deposits, peer-to-peer transactions, and full verified account benefits, then having a secure Chime account is usually the smarter choice.

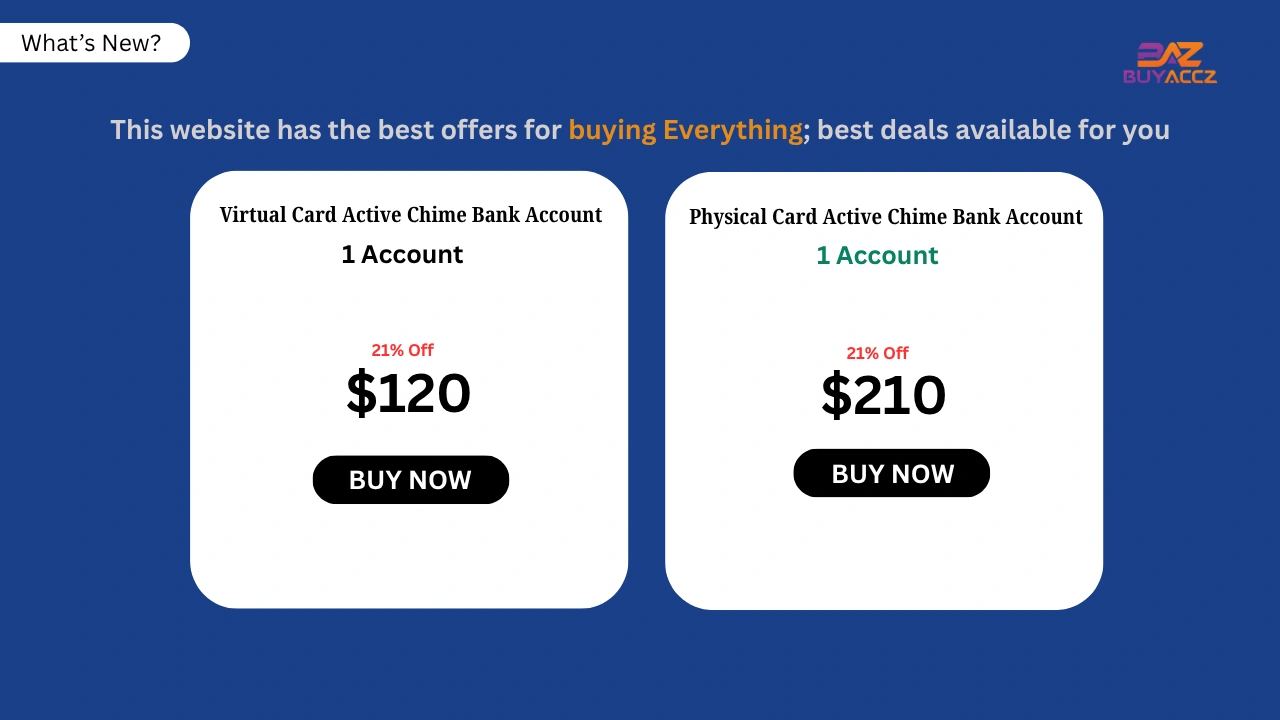

Large numbers of users who first ask about how to receive money without an account often end up searching for verified Chime account for sale,” “Chime account buy, or even options to buy verified Chime bank accounts because of how much more convenient it becomes to manage funds through an official setup.

Using Chime’s Pay Anyone Feature

One of the simplest methods to receive money without your own account is by using Chime’s Pay Anyone feature. This tool allows the sender to send money to your email address or phone number—even if you don’t have a Chime account yet. You will then receive a link to accept the funds.

How It Works

- The sender logs into their Chime online banking app.

- They choose send money via Chime using your phone number or email.

- You receive a notification with instructions to claim your money.

Important Notes

- You must accept the payment within 14 days.

- You’ll need to link your Chime account with a debit card or connect another bank to get the money.

- Not all banks support instant transfers, so delays can occur.

This option is ideal for occasional payments, but for regular transactions, many users eventually decide to buy verified Chime account or open verified Chime account to avoid these limitations.

Linking a Debit Card for Easy Access

If you don’t want to maintain a Chime profile, another option is to connect a debit card. By doing this, you can claim the money sent to you without having to create a Chime personal account. This approach works well for those who prefer to stick with their current bank but still need to receive money from Chime users.

The advantage of this method is that you still enjoy secure transactions and no hidden fees while avoiding the need to manage another online banking app. However, not having a Chime instant account means you lose out on perks like direct deposit with Chime and peer-to-peer transactions that Chime is well known for.

How to Receive Money from Chime Without an Account

The world of online banking is evolving rapidly, and people are seeking faster, safer ways to manage their money. Chime is one of the most trusted platforms today, offering fee-free banking, secure transactions, and quick money transfers. But what if someone wants to send you money through Chime and you don’t have a Chime account? Is it possible to receive funds without signing up? The answer is yes. In this guide, we’ll explore multiple ways to receive money from Chime without an account, while also showing why having a verified Chime account can make transactions smoother and more reliable.

Can You Receive Money From Chime Without an Account?

Many users assume that receiving money through Chime requires a full account. In reality, Chime offers flexible options for those who don’t have a registered account. You can claim funds using Chime’s Pay Anyone feature or link a debit card for direct access. While these methods work for occasional transfers, they have limitations compared to a verified Chime account, which provides instant deposits, peer-to-peer payments, and a more seamless banking experience.

Using Chime’s Pay Anyone Feature

Chime’s Pay Anyone feature allows money to be sent to a phone number or email—even if the recipient doesn’t have a Chime account. Here’s how it works:

- The sender logs into their Chime app and selects Pay Anyone.

- They enter your email or phone number and the transfer amount.

- You receive a notification via email or SMS with a link to claim your funds.

- By following the link, you can provide your debit card information to receive the money.

Important Notes:

- Funds must be claimed within 14 days.

- You need a valid U.S.-issued debit card.

- Not all banks support instant transfers, so minor delays may occur.

This feature is ideal for occasional transactions. However, regular users often find it more convenient to have a verified Chime account for smoother money management.

Linking Your Debit Card for Easy Access

If you prefer not to create a Chime account, you can still receive money by linking an existing debit card. When claiming funds via the Pay Anyone feature, you can provide your debit card details to have the money transferred directly. This method ensures security and fee-free access while avoiding the need to manage another banking app.

Benefits of this approach:

- No Chime account required

- Safe and secure transactions

- Direct access to funds

However, you miss out on features like instant deposits and peer-to-peer transfers that a verified Chime account offers.

Limitations of Receiving Money Without a Chime Account

While receiving money without an account is possible, there are a few drawbacks:

Temporary solutions: You must manually claim each payment.

Delayed transfers: Some banks may take longer to process the transfer.

Missing features: No access to early direct deposit, savings tools, or real-time balance tracking.

For frequent users, opening a verified Chime account is usually the smarter choice.

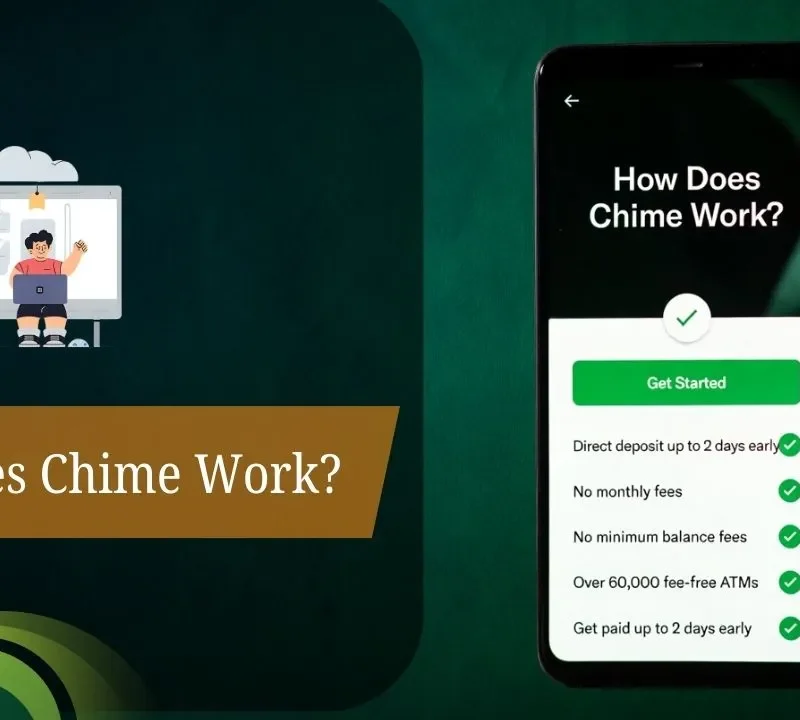

Benefits of Opening a Chime Account

A verified Chime account unlocks several advantages:

Instant Transfers: Money is available immediately without linking a debit card each time.

Fee-Free Banking: No monthly fees or hidden charges.

Extra Features: Access tools like automatic savings, instant peer-to-peer payments, and early direct deposit.

These benefits make it easier to manage finances consistently and securely.

Why People Choose Verified Chime Accounts

Many users eventually decide to open a verified Chime account for convenience and control. With verification, you gain:

- Real-time balance tracking

- Faster peer-to-peer transactions

- Direct deposits that arrive earlier than traditional banks

- Secure, trusted online banking

Verified accounts reduce reliance on temporary methods, saving time and avoiding repeated debit card entries.

Difference Between Chime Personal and Business Accounts

Chime offers options tailored to different needs:

Chime Personal Account:

- Ideal for everyday banking

- Allows salary deposits via direct deposit

- Supports peer-to-peer transactions

Chime Business Account:

- Best for freelancers and entrepreneurs

- Simplifies client payments

- Offers instant deposits for business transactions

Choosing the right type depends on whether you need personal convenience or business-focused functionality.

Alternatives to Chime Transfers

If you prefer not to use Chime, there are alternatives:

PayPal

Venmo

Zelle

Cash App

However, Chime stands out for its fee-free banking, secure transactions, and trusted reputation, which is why many users eventually opt for verified accounts.

Direct Deposit with Chime: A Game Changer

One of Chime’s most attractive features is direct deposit. Employers can pay salaries up to two days earlier than traditional banks. This makes verified Chime accounts especially appealing for people who receive regular income or need immediate access to funds.

Tips for Managing Your Chime Account Balance

- With a verified account, you can:

- Monitor spending in real time

- Track incoming and outgoing payments

- Use automatic savings tools

- Set notifications for transactions

Managing funds becomes simpler and more secure compared to relying solely on Pay Anyone or debit card transfers.

Security and Trust in Chime Online Banking

Chime has built its reputation on safe online banking:

- Encryption: Protects all transactions

- Fraud protection: Alerts for unusual activity

- No hidden fees: Transparent banking services

- 24/7 support: Reliable customer assistance

This level of security is hard to match with temporary transfer methods.

Conclusion: Is It Better to Open a Verified Chime Account?

While it is possible to receive money from Chime without an account, these methods are mostly temporary. For seamless money management, instant payments, and full access to Chime features, opening a verified Chime account is the most practical choice. Verified accounts offer faster transfers, security, and additional tools that make handling finances easier.

- Whether you receive money occasionally or manage a full cash flow, a verified Chime account ensures reliability and convenience.