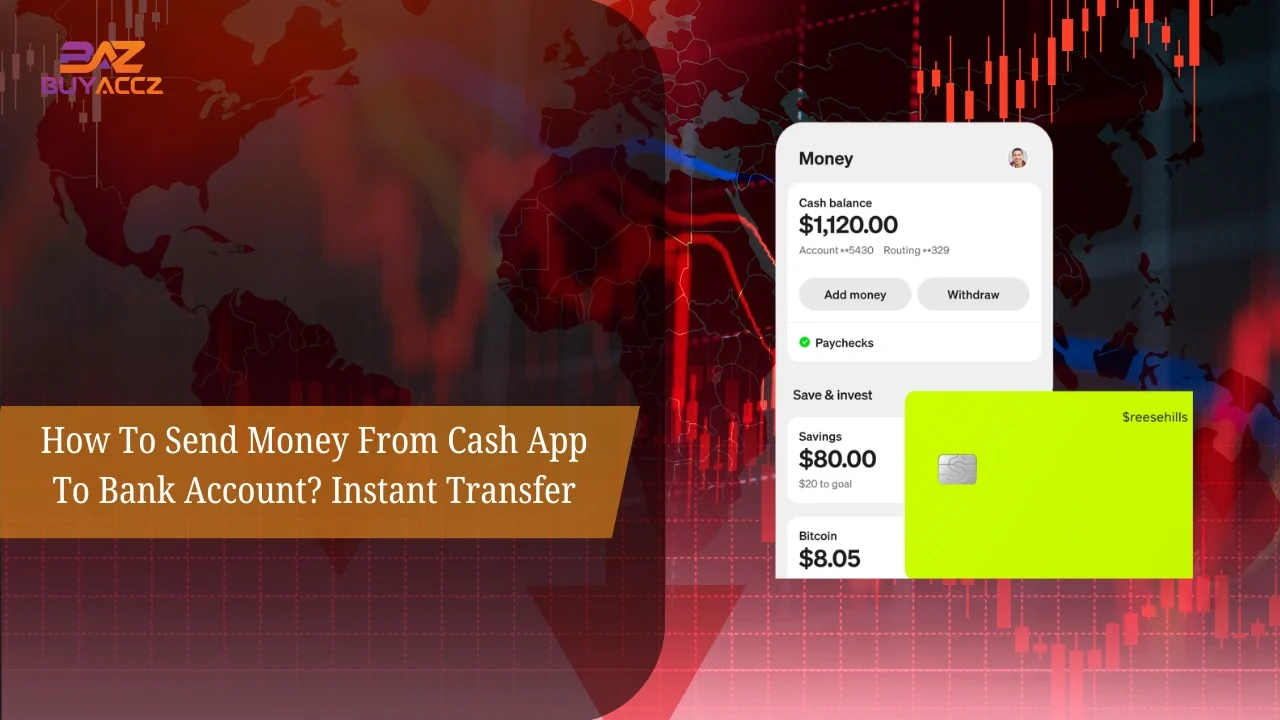

Sending money online has become easier with payment apps like Cash App. Whether you want to withdraw funds, move money to your linked bank account, or simply cash out, knowing how to send money from Cash App to bank account is essential. Many users find it confusing at first, but with the right steps, the transfer process is quick and secure. This guide will explain every detail, from linking your bank account to choosing instant transfers or standard deposits, so you can manage your Cash App balance with confidence.

- We accept unlimited money at the chime bank & cash app, and pay through USDT. If you want to make money so click here.

How to Send Money From Bank Account to Cash App

If you want to add funds to your Cash App account, you first need to link bank account to Cash App. Open the app, go to the profile icon, and select the option to add bank account. Enter your account number, routing number, and other bank information. Once linked, you can move funds from your bank to your Cash App balance. This feature allows you to cover payments, transfers, and Cash App card purchases. Adding your bank also connects Cash App with financial institutions for smoother online money transfer options.

How to Send Money to Bank Account From Cash App

To transfer money back to your bank account, Cash App provides the Cash Out option. Go to your Cash App balance, select “Cash Out,” and choose the amount you want to withdraw. From there, select either standard deposits or instant transfers. Standard deposits to your bank account take 1–3 business days, while instant transfers arrive in minutes with a minimum fee.

Both methods require accurate bank details. This process works whether you use Sutton Bank, a business account, or other financial institutions in the U.S.

How to Send Money to Cash App From Bank Account

Adding money to your Cash App balance is straightforward once your bank is connected. Tap on the money tab inside the app, then select “Add Cash.” Enter the amount, choose your linked bank account, and confirm the payment. The funds move from your bank account to your Cash App account instantly. This method ensures you always have money ready for payments, online money transfers, and transfers to friends. It’s an important step if you want to avoid running out of funds when using Cash App card or other payment apps.

How to Send Money From Bank Account on Cash App

When you send money from bank account on Cash App, make sure your account balances are sufficient. Open the app, select your Cash App payment method, and confirm the transfer process. Using a debit card linked to your Cash App account makes instant transfers possible. You can also use credit card or banking apps like Apple Pay and Google Pay, though fees may apply. The most secure transfer method is through your verified bank account, as this ensures accurate bank details and protects your funds with financial institutions’ security measures.

Step-by-Step Guide to Transfer Money from Cash App to Bank Account

Sending money from Cash App to your bank account is known as using the Cash Out option. Here’s how it works:

- Open Cash App – Launch the app on your iPhone or Android device.

- Tap on the Balance tab – This is located on the home screen (it may show as “Banking” or your available balance).

- Select Cash Out – Choose the amount you’d like to transfer to your bank.

- Confirm Transfer Method – You’ll be given two options: Standard or Instant transfer.

- Standard Transfer: Free, takes 1–3 business days.

- Instant Transfer: Immediate, but usually charges a small fee (around 0.5%–1.75% depending on the amount).

- Select Your Bank Account – Make sure your linked debit card or bank account is correct.

- Confirm and Send – Tap “Confirm” and the transfer will process.

Example:

Imagine you received $200 from a friend for a concert ticket. If you don’t need it right away, you can use the Standard option to send it to your bank for free. But if you want that money in your account instantly for grocery shopping, choosing Instant Transfer makes more sense—even with the small fee.

How to Send Money on Cash App From Bank Account

Sending money on Cash App using your bank account is an everyday task for many. After you link bank account to Cash App, open the payment screen, enter the amount, and select “Pay.” Choose your linked bank account or debit card as the payment option. Enter the recipient’s phone number or email address, then confirm. The funds will transfer instantly, depending on the method. This feature makes Cash App one of the most reliable payment apps for quick money transfers between friends, family, or even for small business account transactions.

-

Cash App Transfer to Bank Using Cash Out Option

The Cash Out option is the most common way to send money from Cash App to your bank. Tap the money tab, select “Cash Out,” and pick the amount. Choose between instant transfers, which carry a small fee, or standard deposits, which take 1–3 business days. This flexibility allows you to manage your account balances effectively.

- Whether you need quick access to paper money, want to cover tax returns, or move funds to a business account, the Cash Out option is a reliable transfer process.

How to Send Money from Cash App to Bank Account? (2025 Updated Guide)

Sending money from Cash App to your bank account is one of the most important features for users who want instant access to their funds. Whether you are cashing out small payments or transferring your entire balance, Cash App makes the process simple, secure, and fast. In this guide, we’ll show you how to transfer money from Cash App to your bank account step by step, along with tips to avoid common issues.

Instant Transfer vs Standard Transfer in Cash App

When you send money from Cash App to bank account, you can pick between instant transfer and standard transfer. Instant transfers arrive within minutes, but a small minimum fee applies. Standard deposits are free, but they take 1–3 business days to complete. Both methods require accurate bank account information and a linked debit card or account number.

For urgent situations like bills or emergency funds, instant transfers are ideal. For routine transfers or tax returns, standard deposits are a secure transfer method without added cost.

How to Link Your Bank Account to Cash App

Before transferring money, you must ensure that your Cash App account is connected to your bank. Here’s how to link it:

- Open Cash App → Tap on your profile icon in the top right corner.

- Go to Linked Banks → Select Linked Banks under account settings.

- Add Bank or Debit Card → Enter your debit card details or select your bank to connect directly.

- Verify Your Information → Follow the on-screen prompts to complete verification.

Practical Tip:

Always double-check the routing and account numbers when linking a bank account. Entering incorrect details can delay your transfer or send money to the wrong account.

How to Withdraw Money From Cash App

Withdrawing money from Cash App is the same as sending money to your buy verified cash app accounts. Use the Cash Out option, select the amount, and confirm your bank account details. If you use a debit card, instant deposits will move funds quickly. For those who prefer standard banking, 1–3 business days is the usual timeframe. This withdrawal method also allows you to move funds into online banking systems, wire transfers, or even transfer to other payment apps like Google Pay. Always check your Cash App balance before starting the transfer process.

Linking Bank Account to Cash App for Transfers

To send or receive money, you must first link bank account to Cash App. Open the app, select the profile icon, and tap on “Linked Banks.” Add your account number, routing number, and confirm your bank details. Once done, you can move funds between your bank and Cash App balance.

Linking your bank also makes Cash App direct deposit available, which allows paychecks and tax returns to be deposited directly. This connection with financial institutions ensures secure transfers and smooth money management.

Updating Bank Details in Cash App

If your bank account changes, you must update Cash App bank details. Go to the profile icon, select “Linked Banks,” and remove the old account. Add your new account number and routing number, then confirm. Updating bank details is an important step to avoid failed transfers, rejected payments, or delays in direct deposit.

This is especially crucial for business account users who rely on Cash App for regular payments. Cash App customer service can help if you face issues while updating your bank information.

Managing Cash App Balance and Bank Information

Keeping track of your Cash App balance and bank account ensures smooth money transfers. Always check your balance in the money tab before sending funds. Accurate bank account information, linked debit card details, and correct routing number are necessary for secure transfers. Monitoring account balances helps you avoid overdrafts, failed transfers, or fees. You can also connect Cash App with Apple Pay and Google Pay for more flexibility. This habit ensures that your transfer process, instant deposits, and standard transfers run smoothly every time.

Why Transfer Money from Cash App to Bank Account?

Linking Cash App with your bank allows you to:

- Instantly withdraw your balance.

- Move funds securely without fees (for standard deposits).

- Access cash anytime using your debit card.

- Avoid keeping unused balance in the app.

If you’re using Cash App for personal or business transactions, transferring to your bank ensures smooth money management.

Secure Transfer and Customer Support

Cash App uses encryption to protect your bank details and funds during transfers. Always double-check bank account information before confirming. If something goes wrong, you can contact Cash App customer service using your phone number or email address.

They can help with failed instant transfers, updating bank information, or questions about Cash App card payments. Using secure transfer practices, such as verified accounts and linked bank account checks, is an important step to avoid problems. Protecting your financial score and funds should always be a priority.

Step-by-Step: How to Send Money from Cash App to Bank

- Open the Cash App on your device.

- Go to the Balance tab.

- Tap on Cash Out.

- Enter the amount you want to transfer.

- Select either Instant Transfer (small fee) or Standard Transfer (free, 1–3 days).

- Choose your linked bank account or debit card.

- Confirm with your PIN or Touch ID.

✅ Your money is on its way to your bank account.

Standard vs. Instant Deposit – What’s the Difference?

- Standard Deposit (Free): Takes 1–3 business days.

- Instant Deposit (Fee 1.5%): Money arrives in your bank within minutes.

👉 If you need cash urgently, Instant Deposit is the best option.

Common Issues When Sending Money to Bank Account

Sometimes Cash App transfers fail. Common reasons include:

- Incorrect bank account details.

- Outdated Cash App version.

- Insufficient balance.

- Poor internet connection.

Solution: Update the app, double-check your bank info, and ensure your balance is enough before cashing out.

Conclusion

Knowing how to send money from Cash App to bank account is an essential skill for managing your money. From linking your bank account and debit card to choosing between instant transfers and standard deposits, Cash App offers flexible options. Always follow the important steps, keep your bank details updated, and use secure transfer methods.

- Whether you’re cashing out funds, moving money for tax returns, or sending payments to friends like BUYACCZ.COM, Cash App makes the transfer process fast and reliable.

FAQs About Sending Money From Cash App to Bank Account

1. Can I send money to bank account from Cash App without linking a bank?

No. You must link bank account to Cash App or add debit card before you can move funds to your bank.

2. How long does it take to transfer money from Cash App to bank?

Instant transfers take minutes with a fee, while standard deposits take 1–3 business days without charges.

3. Can I use Cash App to send money internationally?

Currently, Cash App only supports transfers within the U.S. using U.S. mobile number and financial institutions.

4. What if my bank details are wrong?

Incorrect account number or routing number will cause transfer failures. Update Cash App bank details immediately to avoid issues.

5. Is it safe to transfer money from Cash App to bank?

Yes. Cash App uses encryption and secure transfer systems. For added protection, monitor your account balances and contact customer service if needed.