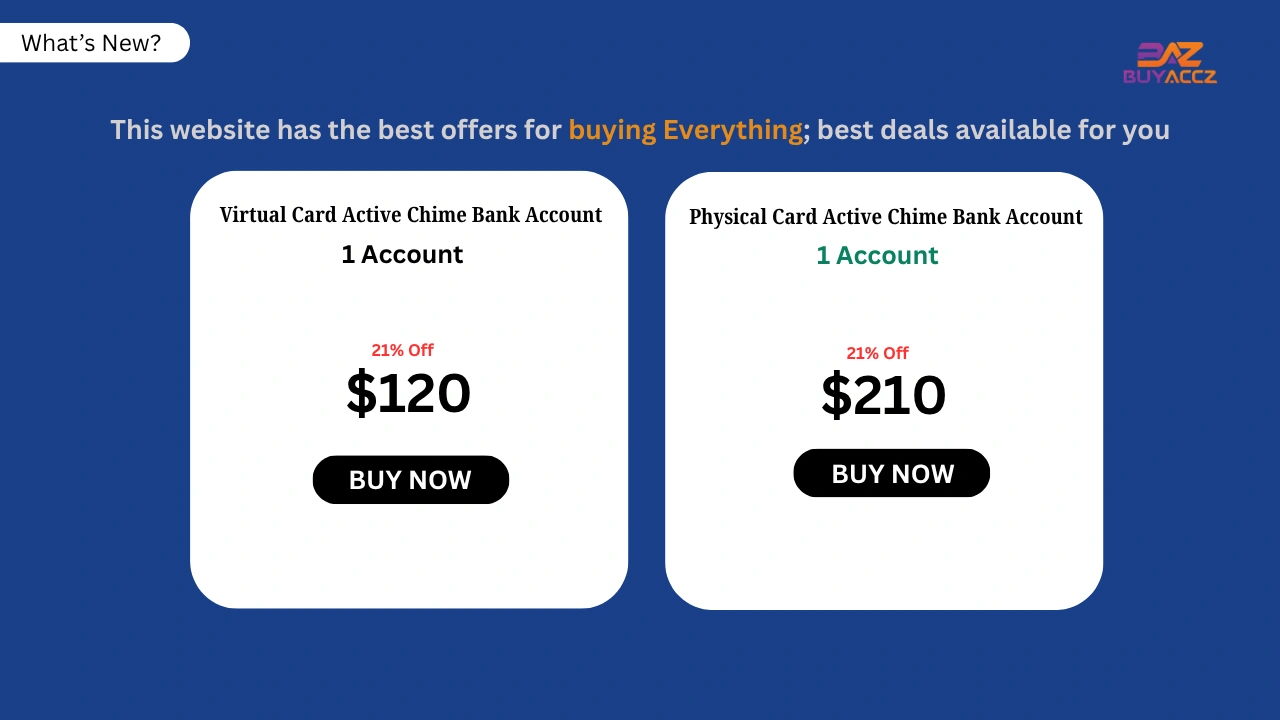

It’s not very hard to transfer money from your Chime account to your bank account; it can be made easy with the proper tools. If you have the Chime app or are connected to third-party reseller mobile apps, such as Cash App or Venmo, this guide will take you through how to make such a deposit. Find out how to add an external bank account, deal with ACH transfers, and even increase your transaction limit when you select to Buy Verified Chime Accounts for faster access to send and receive instant transfers and a higher limit.

How to Link Your Chime Account to a Bank Account

Your Chime account will need to be connected to an external bank account from which you wish to transfer funds to send money. This link provides you with the ability to send and receive money from your Chime account when using the Chime app. Verify that you have the right account type, account number, and bank credentials. Having your info verified allows you to bypass any delays when you transfer money back and forth between your Chime bank account and another U.S. bank. buy verified Chime bank accounts to make setup easier if necessary.

Have Questions? Contact Us Anytime!

📨 Telegram: @buyaccz

📱 WhatsApp:

Add Bank from the Chime App Settings

To connect a bank account, open the chime checking account app, select “Settings,” and then select “Add Bank.” Enter the account number and routing number for your external bank, then click “Confirm.” This step sets up your account for money transfers and activates your bank-to-bank transfers. Since inaccurate bank information can lead to unsuccessful ACH transfers and lost funds, you must make sure the account information you enter is legitimate. Mobile apps securely simplify this linking process.

Select the Correct Account Type for Transfers

Selecting a checking or savings account type is crucial when connecting your external bank. Your transaction may be delayed or your transfer may not process at all if you choose the incorrect account type. Your Chime account can handle both incoming and outgoing transfers and communicate with your external account if you choose the right option. To avoid errors and gain instant access to more features, some users would rather buy verified Chime Account credit card options.

Steps to Transfer Money Instantly From Chime to Bank

Once your accounts are connected, moving money is simple and quick. You can send money to your external bank account securely with the Chime app. You can also send money with third-party mobile apps, such as Cash App. How Fast Can You Transfer Money with Chime? How fast you can send money with Chime is either instant or 1-2 business days based on the specific method you have and the type of bank account you’re sending to, as well as whether you have a verified Chime account or a Buy Verified Chime Bank Accounts.

Use the Chime App for Simple Transfers

Go to the Chime app and select “Move Money.” Under “Transfer Funds,” pick your external account, input the amount you’d like to transfer, and confirm the transfer. Standard and instant transfers -Chime offers standard and instant transfers, based on the type of account and the banking solution of the user. If you’ve opened a new account recently or you prefer more reliability, it’s best to buy verified account chime options, which will be subject to fewer transfer restrictions and will provide more support for money transfers.

Monitor Account History After Sending Money

After you have transferred the money, you must verify that your transaction completed successfully by examining your Chime history. Then along with double charging, you’ll also avoid the failure to transfer—a missed payment. The Chime app, as well as most mobile apps, offers real-time updates and transfer confirmations. For users with regular use, a Buy Verified Chime Bank account allows quicker and more convenient access to funds on other platforms, such as online banking systems.

Can I Transfer Money From Chime to Cash App Instantly?

Yes, you can instantly move funds from your Chime account to your Cash App account. Connecting your Chime bank account or debit card to the Cash App enables fast transfers and gives you greater control over your payments. This method is extremely helpful if your external bank does not support instant transfers. Many users also buy verified Chime accounts to reduce delays and enhance the effectiveness of banking services across all platforms.

Connect Chime to Cash App Using Bank Info

Navigate to the Cash App’s settings, choose “Linked Banks,” and then press “Add Bank.” For quicker verification, enter your Chime account number and routing number or use your Chime debit card. You can use the Cash App to make deposits and withdrawals from your Chime bank account after linking. buy Verified Chime Bank Accounts that effortlessly integrate with well-known payment apps is frequently advised for optimal outcomes and seamless verification.

Transfer Money Seamlessly Between Apps

After connecting your accounts, launch the Cash App and select “Add Cash” to add funds from Chime. Funds will be promptly deposited into your Cash App account. This procedure is among the quickest ways to process fund transfers between two entities. For users who frequently make multiple daily transfers, it is advisable to purchase a Chime verified account profile in order to enjoy higher limits and easily connect Chime with other mobile apps.

Use Cash App as a Bridge to Other Banks

If your U.S. bank doesn’t support instant transfers from Chime, you can transfer money from your Chime account to Cash App and then from Cash App to your external bank. This method provides faster turnaround times and more flexibility. Many users streamline this setup by choosing to Buy Verified Chime Accounts, which are already optimized for compatibility with Cash App and other external bank accounts.

Understand Chime Transfer Limits and How to Overcome Them

Daily and Money transfer limits are applied to your account, which means that it is safe and less fraud is committed. These restrictions could be different based on your account type or account history as well as verification level. If you’re under restrictions, you’ll probably opt to Buy Verified Chime Bank Accounts, as these generally have lower hindrances and give more space for ACH transfers for both personal and business accountholders.

Know Your Daily and Monthly Transfer Limits

Chime typically sets a daily cap on the amount of money you can send to another bank. Depending on how your account was validated, monthly caps might also be applicable. To examine your existing limitations, go to “Account Limits” in the Chime app. Buy Verified Chime Account plans with higher banking activity thresholds is a wise choice if you want to avoid reaching these caps and disrupting your cash flow.

Increase Limits Through Account Verification

One method for raising your transfer limits is to fill out the full verification process with Chime. This may entail validating your email address/phone number and also providing some form of valid identity documentation. Although successful, this process is also time-consuming. That’s why most people choose to Buy Verified Chime bank Accounts, such as pre-approved services and more transfer limits—enabling you to handle Huge Transaction flows and business stuff with less stress.

Avoid Payment Holds With Trusted Accounts

When using an unverified or new account, Chime may flag or delay certain transfers, particularly large ones. Users who depend on quick access to their money may find this frustrating. You can avoid these problems, lessen transfer holds, and enjoy faster processing times for both ACH transfers and instant payments through apps like Cash App by opting to Buy Verified Chime Bank Accounts.