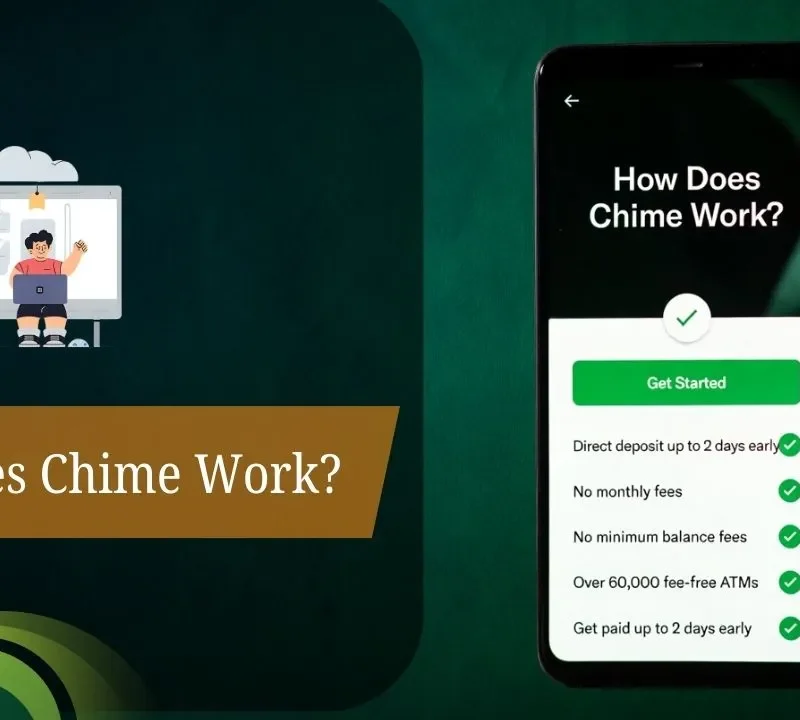

You’re not the only person wondering, “What time does Chime direct deposit hit?” In order to receive government benefits and pay cheques more quickly than traditional banks, millions of users rely on Chime’s early direct deposit. Depending on the employer and the payment file schedule, direct deposits with a verified Chime account typically arrive up to two days early.

To properly manage funds, buyers of verified Chime accounts must be aware of deposit times.

Have Questions? Contact Us Anytime!

📨 Telegram: @buyaccz

📱 WhatsApp:

Chime Direct Deposit Time on Weekdays

On a business day, the majority of Chime users view their direct deposits between 12 and 8 a.m. (EST). When your employer or benefits provider submits the deposit through the ACH network determines the precise time.

One of the main factors influencing people’s decision to purchase verified Chime accounts rather than traditional banks is early access. This quick processing time is made possible by Chime’s partnerships with Stride Bank and The Bancorp Bank.

Does Chime Direct Deposit on Weekends?

Fortunately, like most fintech companies, Chime does not hold direct deposits over a weekend. Transactions are not processed by the ACH network on weekends. So if your payday occurs on a weekend, your funds are likely to come on Friday.

Individuals purchase verified Chime bank accounts so that they can get ” regular weekday deposits” and have better control over their budget.

How Early Can You Get Paid With Chime?

Compared to traditional banks, Chime users frequently receive their payments two days earlier. This is so that Chime can process the request for direct deposit as soon as the payment file is sent by the employer’s bank.

In order to take advantage of early access to paycheck funds without having to wait for paper checks, more people are opting to Buy verified Chime accounts.

Chime Deposit Time on Bank Holidays

Your direct deposit will be postponed if there is a federal holiday. No electronic funds transfers (EFTs) are processed because the banking services that handle deposits are closed.

Therefore, your Chime deposit might arrive on the following business day if you’re expecting money and there’s a bank holiday. Customers who purchase verified Chime accounts value the app’s clarity about the effects of holidays.

What Affects Chime Direct Deposit Timing?

There are a few things that determine when the money you deposit into your Chime Spending account becomes available:

- Employer payroll schedule

- The time the payment file is submitted

- Federal or bank holidays

- The ACH network timing

- If your account is verified

Verified chime account buyers are most probably to have a direct deposit earlier with a free Chime bank account directly, mostly if the direct deposit is associated with a payroll company.

Can You Speed Up Chime Direct Deposits?

You can’t change the ACH processing speed, but having a verified Chime checking account ensures smoother and faster fund transfers. Also, asking your employer to submit payroll early may help.

Some users buy verified Chime bank accounts specifically for early access perks — like getting paid earlier than coworkers using traditional banks.

Direct Deposit vs. Paper Checks: Why Chime Wins

It may take five to ten business days for paper checks to clear. Your money is frequently accessible through Chime’s direct deposits 24 to 48 hours following your employer’s payroll processing.

Many people choose to buy verified chime bank account because of this convenience. You get a mobile app, a Chime savings account, and instant notification when funds arrive.

Does Chime Show Pending Deposits?

Yes, the Chime app displays pending deposits when your payment file has been received. But the money won’t be accessible until Chime processes it, which usually takes place in the early hours of the morning.

It’s important to know when the deposit occurs. To prevent delays or verification holds, financial experts advise using a verified account.

How Government Benefits Direct Deposits Work on Chime

If you are earning money from government benefits like SSI, SSDI, or unemployment, Chime could make your money available a couple days sooner than a traditional bank, the same as a paycheck. Chime doesn’t hold onto your benefits — it disburses the money when the benefits provider sends it.

For quick and easy deposits, many people buy verified chime bank account and Chime for their federal payments.

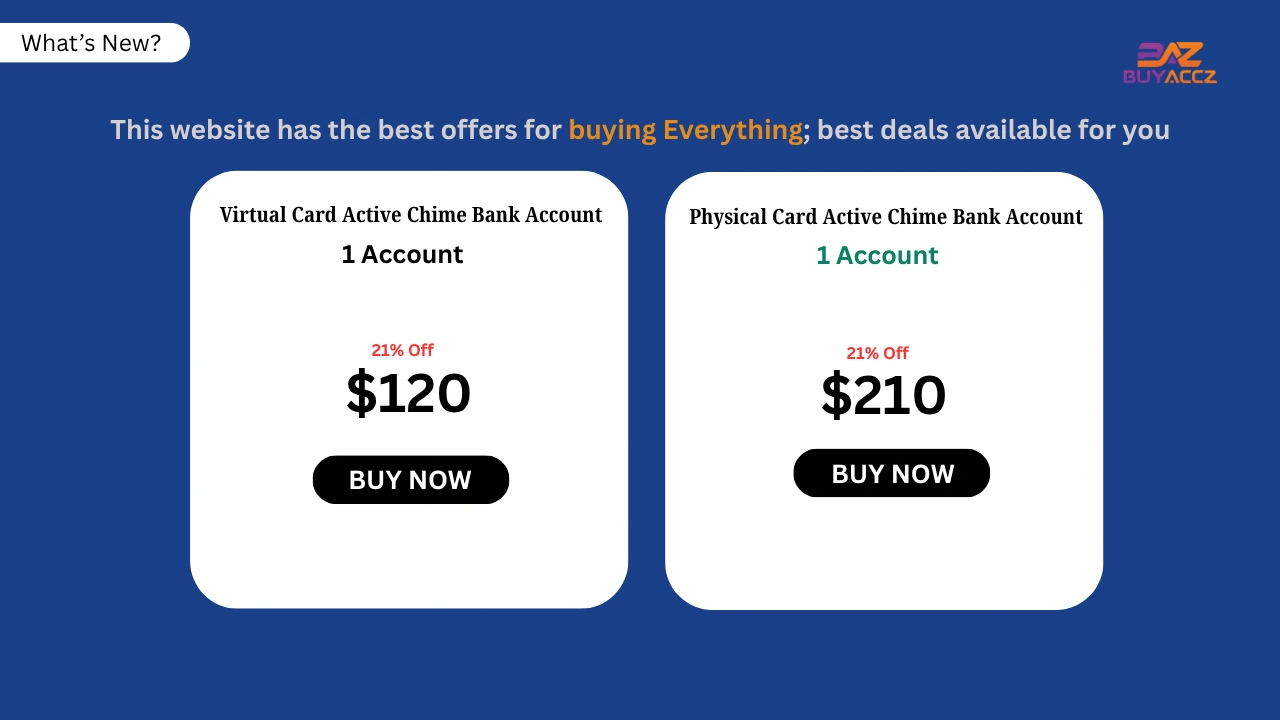

Why Buy Verified Chime Accounts?

People seeking immediate access to direct deposit funds frequently buy verified Chime accounts due to these factors:

- Faster ACH transfers

- Instant notifications

- Early deposit access

- No hidden fees

- Improved verification

- Smooth employer integration

- Multiple deposit sources

- No paper checks required

- Savings account included

- 24/7 mobile banking

With a verified Chime account, your direct deposits are not supposed to have hitches, delays, or lack of ID verification issues.

How to Set Up Direct Deposit in Chime

To get started with direct deposit, open the Chime app and tap “Move Money. Choose “Set Up Direct Deposit,” then either send your direct deposit form by e-mail or print it for your employer.

- You’ll need to share:

- Your Chime account number

- Your Chime routing number

- Employer or payroll company info

Plus, as soon as that’s submitted, direct deposits will begin appearing in your Chime account, usually early on a scheduled payday.

Final Thoughts: Plan Ahead for Chime Direct Deposit Timing

Even though Chime makes every effort to deliver your money on time, it’s crucial to realize that deposit times may be impacted by ACH transfers, bank holidays, and employer schedules.

Buy verified Chime account makes sense if you depend significantly on timely deposits. It removes uncertainty, lets you access direct deposits fast, and provides a full-featured banking experience powered by financial technology.